Issue #23: Barnes & Noble’s Quiet Comeback

Nowadays, there are a plethora of options for entertainment. You can go outside to explore, open your phone to play games, use a tablet to browse the news, play video games, watch TV, and even pick up a book. On the retail front, reading books has always been a staple part of retail, with libraries and bookstores often anchoring retail areas. However, as shown in the graph above from Scholastic, reading, and interest in reading are falling in kids and teenagers. Since 2010, the number of kids who are frequent readers dropped 9 percentage points from an already low 37% to 28%. It does not seem like this part of the decline is done falling. Coupled with the rise of digital products, used both for reading and not reading, it is a troublesome time to be a book retailer. Except at Barnes & Noble, which is having a quiet comeback as the only major book retailer chain left.

Here is the timeline of events:

October 2018 🔴 - the Board of Directors decides to sell the company

August 2019 🟡 - Elliott Investment Management acquires the company and installs James Daunt, the CEO of UK bookstore Waterstones (also owned by Elliott) where he was able to turn Waterstones profitable for the first time in many years, as the CEO of Barnes & Noble

March 2020 🟡 - During the Covid-19 pandemic, the stores were temporarily closed and refurbished

April 2022 🟢 - Daunt has turned around sales in-store and online and one example is a 500% increase in graphic novel and manga sales (newer categories)

August 2024 🟢 - Barnes & Noble has opened 32 stores so far in 2024 and is on track to open 26 more in 2024 (the most opened in a single year since 2009)

Under James Daunt, it is clear Barnes & Noble has turned it around. Since it is a private company, we no longer get access to the financials, but based on the store openings and nuggets coming through interviews on financial performance, it seems that things are headed in a positive direction. I am very impressed with what James Daunt has done by keeping things focused on three core strategies, which is harder than it seems. Here are the three core pillars:

In-Store Experience - Invested in the in-store experience with construction, designing better layouts of the stores, and empowering managers to refresh the layout of the store based on what sells well in their store

Operation Improvements - Better purchasing processes and using the copious amounts of open real estate from other large retailers struggles to their advantage (taking over a beautiful vacant Walgreens in Chicago)

For retailers struggling, there is a strong chance that focusing on these three core areas will help identify the issue and lay out a path to improvement. That is why what James Daunt is so impressive - keeping it simple has made it so the comeback is possible. Plus, it helps that since 2020, US print book sales have risen by 8.9% due to an increased interest in books. Anecdotally, I see a lot of my peers picking up books more frequently than before. Take the tailwinds of strong interest in reading plus smart operations and strategy and you are headed towards success.

Dog Haus Partners with Jake Paul

Dog Haus, the 58-unit restaurant with both biergartens and fast casual spots, announced it has partnered with controversial Youtuber/Boxer Jake Paul to help spur growth. The partnership involves Paul promoting it during his fight with Mike Tyson, launching 25 franchise locations together, doing meet and greets, and adding Paul to the board of directors. This partnership comes at a time when Dog Hau’s main concept, the Biergarten, is struggling. According to its Franchise Disclosure Document, a legal disclosure document given to individuals interested in buying a franchise as part of the due diligence process, revenue for the biergarten has fallen from $1.8M per unit in 2021 to $1.66M in 2023. In contrast, their fast-casual concept is performing a little better, growing from $1.26M per unit revenue in 2022 to $1.37M in 2023. It is not clear which concepts Paul will be utilizing. I believe this is one of the first deals where a YouTuber has partnered with a restaurant like this. I have seen many athletes do similar deals but not entertainers. Nonetheless, this partnership will certainly be interesting to follow along. I anticipate more retailers to reach out to Youtubers to partner.

McDonald’s E. Coli Outbreak in Quarter Pounders

This week McDonald’s was unfortunately the latest in several food recalls that have been sweeping the United States across fast food (more context on the food recalls read here). The latest outbreak has been tied to the Quarter Pounder hamburger, in particular the onions and beef, although the CDC has not determined a specific source yet. So far, 75 people have been ill according to the CDC. In response, Taylor Farms, the onion supplier to McDonald’s and other fast food restaurants, has recalled products and McDonald’s has removed the Quarter Pounders from 20% of locations. The outbreak seems to be tied to a single source in the supply chain, even though they do not know the source yet, unlike Chipotle’s struggles over the years. On a more positive note, due to advances in protocol and technology, we are able to identify and take action on these issues much faster than in the past. However, the concern is many different retailers and restaurants have faced issues in the past couple of months with recalls due to illnesses from their products. This type of issue can snowball as consumer distrust of the food increases, which would harm retail overall. Hopefully, these issues will be identified and addressed, and going forward for the rest of the year this is not an issue anymore, so that consumers feel safe eating out.

Whole Foods Trend Report Released

This week, Whole Foods released its 2025 trend report, which I highly recommend giving a full read. Given that it is an annual report, I figured it would be worth taking a look back at the 2024 report for the first time to see what stood out. The trend that stood out to me was #1, Put the “Plant” Back in “Plant-Based”. Here is the excerpt that stood out to me:

We’re seeing new and emerging protein-forward products with mushrooms, walnuts, tempeh and legumes in place of complex meat alternatives. Even plant-based milk alternatives are participating, with some brands simplifying labels to just two ingredients

I have been following the alternative meat protein movement for a while. One thing that never aligned with these product was the consumer desires. Typically, people who are opting for alternative meats, are also the ones wanting clean, natural ingredients. When you look at the leaders of the category, like Impossible and Beyond, the processed ingredients just did not match with the natural vibe the customers typically look for. Looking back, this is why I think this trend is so fascinating, even above the others that were listed. Despite the intentions of wanting cleaner products, the products they mentioned are not that clean. Sure, compared to your average product, it is very clean, but based on the standards these customers are looking for, I don’t think the products they listed suffice. I strongly believe for a plant-based product to be successful, it needs to be natural, not artificial. It is interesting that in the latest trend report, Plant-Based was only mentioned once, at the bottom in a more supplement context rather than a vegetarian/meat replacement context. I believe plant-based will be a big trend in 2025, but curious to see what everyone thinks?

Turnover at the Top of Amazon Fresh

This week Amazon announced after three years its SVP of Worldwide Grocery Stores, Tony Hoggett, is departing the company. Tony spent almost all of his career at Tesco, the UK supermarket, spending 16 years leading various parts of the business in the UK and across the world. Recently, Amazon has been trying to make more headway in grocery. Some of the initiatives that have gone on are creating a 3,800 square-foot Amazon branded grocery store in a Whole Foods store and developing an automated microfulfillment center to get Amazon orders while shopping at Whole Foods. These two initiatives are not the typical grocery world that Hoggett came from. It will interesting to see where Amazon goes from here as it tries to make a dent in the groceyr world. According to a PYMNTS Q2 report, Walmart’s grocery store market share is 20% and Amazon’s is 2.7%. It will be interesting to see where Amazon goes from here. Do they appoint another traditional grocery veteran or someone from the eCommerce world?

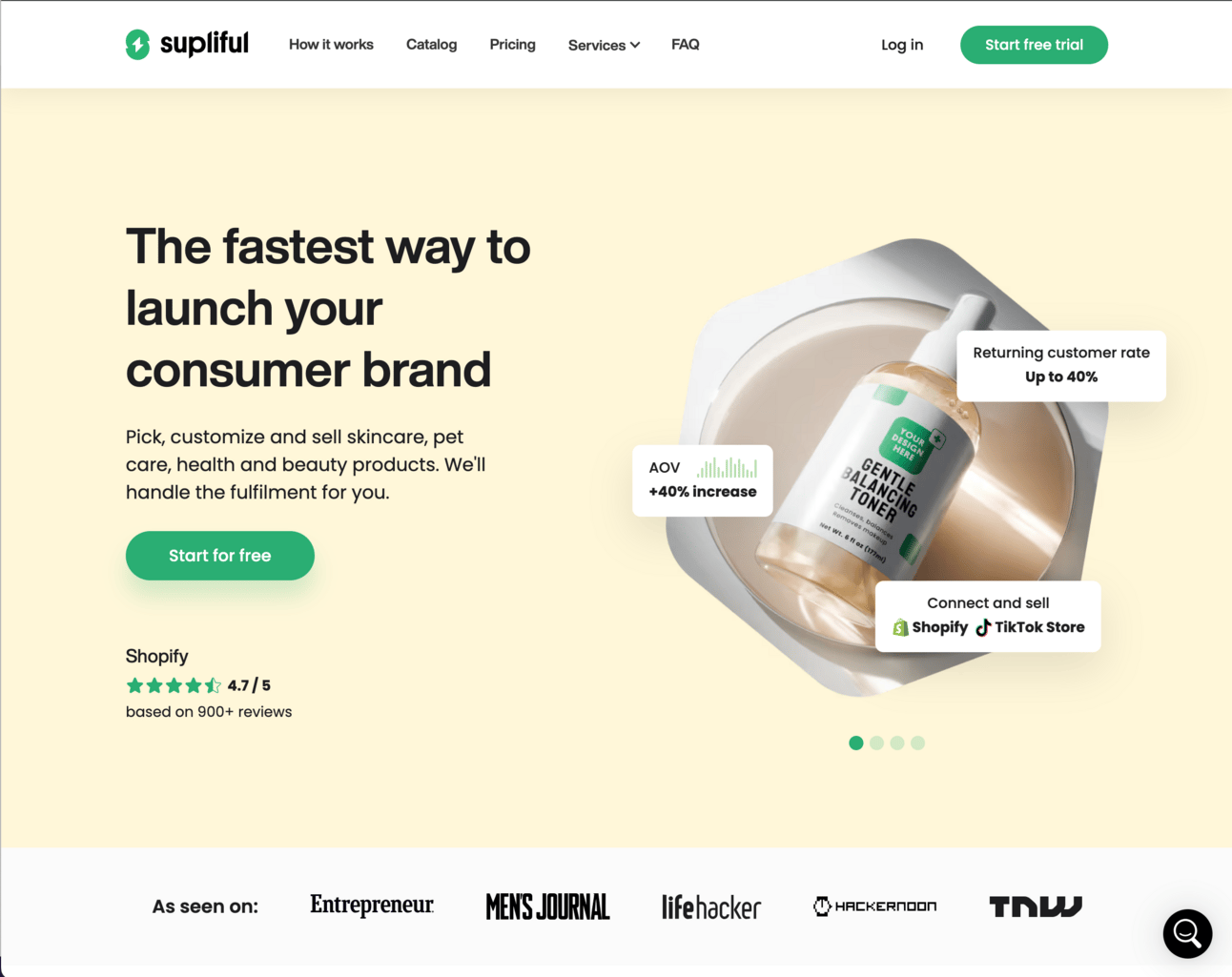

Summary: Supliful is a white label skincare, pet care, health, and beauty manufacturer that helps CPG brands get off faster because they do the production and fulfillment

My take: Whether you are looking to start a CPG brand, or are a creator looking to launch a product, one of the hardest parts is the manufacturing and getting off the ground. By outsourcing that process, the speed to market decreases and the ability to test/iterate rapidly increases

Founder(s): Rihards Piks and Martins Lasmanis

Amount raised & investors: $1.9M from Diaspora Ventures, ZAKA VC, Startup Wise Guys, and BADideas.fund

Pricing: Fee per order

Interested? Book a demo here

Additional Links:

Keurig Doctor Pepper announced that it is going to acquire Ghost Energy (read more here for a great breakdown)

As interest rates drop, it is expected that people will spend more money on home repairs, improvements, and renovations (read more here)

Shoppers are using more digital tools while in retail locations (read more here)

Immi ramen was featured on national TV with CNN as part of the rise of ramen (read more here)

Raising Cane’s continues to grow by having a simple menu (read more here)

L’Oreal continues to struggle as people in China are buying less (read more here)

FTC wins its lawsuit to block the merger of Tapestry and Capri (read more here)

The Paper Store is planning on investing $60M in new brick-and-mortar stores (read more here)

Tractor Supply Co, the home improvement and farm retailer, acquired online pet and animal pharmacy Allivet as it tries to expand more in the animal space (read more here)

PetSmart hires former CEO of Foot Locker as its new CEO (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.