Issue #27: Cava Q3 Earnings & Jersey Mikes Acquisition

Happy early Thanksgiving! I am so thankful for all the support you all have given me since the start of this newsletter. I hope everyone has a wonderful time celebrating with friends and family. From a food perspective, I am personally most excited for the stuffing and the day-after turkey sandwich. What are your favorite Thanksgiving foods?

Some highlights from Cava’s Q3 earnings

When I was in middle school, I went to Chipotle for the first time and had a great experience. Being the entrepreneurial-minded person I was, one of my first thoughts was this bowl concept needed to exist for Mediterranean food. I even wrote a business plan and strategy for it, but unfortunately, I never got it off the ground. Unlike me, Brett Schulman, the founder of Cava, executed on his idea and now has the hottest retail or restaurant stock in the country. Currently trading at 16x revenue, investors are betting on the future growth opportunity and long-term potential. In terms of number of locations, just for comparison, Chipotle has about 3,600 locations and is still growing. Assuming Cava can hold $2.75M in revenue per location, which is pretty low, 1000 stores would yield just under $3B in revenue annually, not too shabby.

Chipotle is a great comp because of the similarity in products and similar rapid ascension in the eyes of the market. So I put together some metrics across the two:

Q3 Metric | Chipotle | Cava |

|---|---|---|

Revenue | $2.8B | $241.5M |

# of Locations | 3,600 | 352 |

Same Store Sales Growth | 6% | 18% |

Revenue per Location | $3.1M (based on 3,600 locations) | $2.75M |

Net Income $ / % | $387.4M / 13.8% | $18M / 7.4% |

Restaurant Level Profit Margin | 16.9% | 25.6% |

Earnings Multiple | ~7.5x | ~16× |

As illustrated in the chart, the difference in scale is mind-boggling for two public companies. Chipotle produced more net income (profit) then Cava did in revenue. However, to public investors, Chipotle in many aspects has already reached its cap in many ways. Aside from international expansion, Chipotle doesn’t have much left to grow into. On the other hand, Cava has significantly stronger same-store sales growth, revenue per location growth, and restaurant-level profits. Plus, the ability to add at least 1,000 more stores. This future potential is what excites the public markets.

However, it isn’t just the public markets that can benefit from Cava. There is a lot for other retailers to learn as well. What does Cava do well?

Digital ordering is a big part of the mix (digital revenue represents 35.8% of revenue)

Focus on in-store design and experience via Project Soul adding in a cozier dining experience in the restaurant (Starbucks take notes)

Quality products and constant innovation of the product (just launched Pita Chips)

Between these core pillars, plus the financial strength, Cava is poised for success over the next couple of years. It will be exciting to follow over the next couple of years. How many stores do you think Cava will have over the next couple of years?

In five years, how many locations will Cava have?

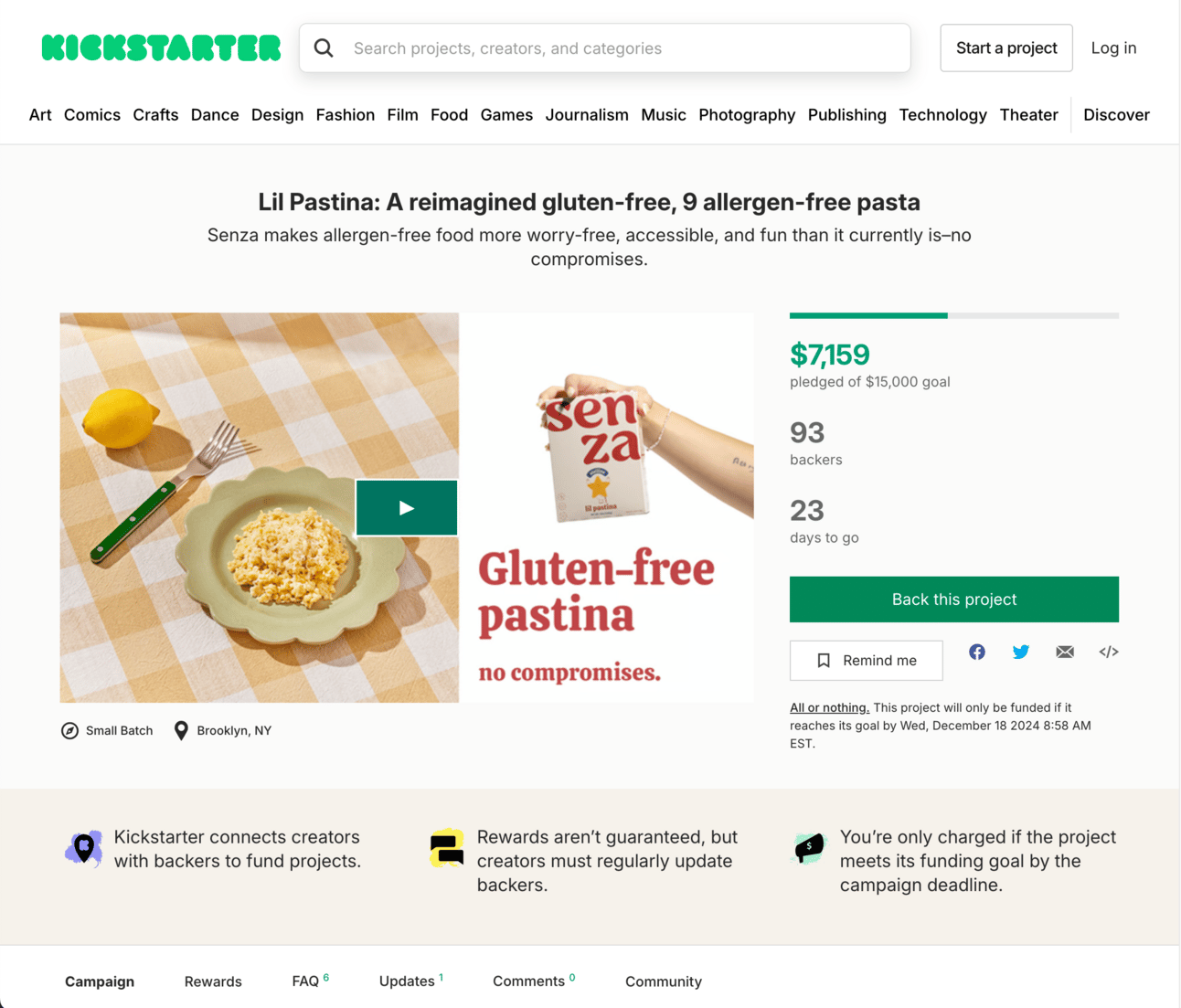

Lil Pastina Kickstarter campaign

Alternative Sales Channels: Military Bases and Kickstarter

One trend I have discussed frequently in the newsletter has been the opportunity for emerging brands to leverage alternative sales channels. This week I came across two unique channels I wanted to highlight:

Immi Ramen launched on military bases

Snaxshot’s Andrea Hernandez advocates for more emerging brands to leverage Kickstarter after recent success of Rotten and Eat Senza, on top of the past success of Fly By Jing

Both these channels have trade offs, but at the end of the day it is another opportunity to drive trial and sell product. Emerging brands need to take advantage of alternative channels, like food service, because there is less competition and higher margins. Especially if you can find super-untapped channels, there is a huge opportunity to grow. Mainstream retail will always be a core part of the business, and be where the business is made or broken, but these alternative channels can really drive success early on. What are some of your favorite nontraditional retail channels?

Blackstone Acquires Jersey Mikes

September 2019 - Inspire Brands purchases Jimmy John’s from Roark Capital

November 2021 - Firehouse Subs is purchased by Restaurant Brands International

August 2023 - Subway sells to Roark Capital

November 2024 - Blackstone buys Jersey Mike’s

As illustrated in the timeline above, fast-food sandwich chains have been a popular target for large restaurant conglomerates and PE firms. Why? They are generally stable, recession-proof business that provide an affordable product and always have room to grow. However, if you ask customers of those chains, they would argue that since the acquisitions, quality has gone down. This week Blackstone became the latest PE firm to purchase a sandwich chain, Jersey Mike’s, for $8B. Jersey Mike’s is on a tear. Currently, it is doing $4B in annual sales, has 3000 locations (mostly franchisees), and is growing at a roughly 20% yearly clip. Not too shabby and clearly a reason why Blackstone wanted to get a piece of it. Still, despite what a strong business it is right now, as illustrated with some of the other acquisitions, it can go really bad fast. The good news is the owner will stay on as CEO and wants to grow to 10,000 locations. However, if he is not given opportunity to continue leading as he has, I believe that is where the issues will arise. As many of Jersey Mike’s 3,000 locations anchor and drive traffic to retail areas, the impact this acquisition will have on retail could be tremendous.

Gap Reports Positive Q3 Earnings

Pivoting from public restaurants to apparel, Gap released Q3 earnings and they were strong overall. Net sales and same-store sales were up. Interestingly, and not the best sign for retail, in store sales decreased, while online sales increased and now represent 40% of sales. Additionally, Gap has been focusing on turning around the Athleta brand with new marketing and products, and it is working. Out of all the four Gap brands, Athleta grew the most. Athleta has also been helped by the rise in popularity of activewear/athleisure, but they have been in the right place to capitalize with a good basic assortment and limited edition items. For apparel retailers, it is always helpful to have a strong basic assortment and then filter in additional limited items to draw people back.

One final interesting nugget to close the earnings call, the Gap CEO said "Our holiday season is off to a strong start." As a result, expectations for the rest of the year has been raised.

Shorter Holiday Season Causes Concerns

Despite positivity from the Gap CEO about early holiday seasons, retailers are concerned about the holiday season. Overall, retail sales are expected to rise, which is great. However, there are five fewer days between Black Friday and Christmas this year because of how late Thanksgiving is. While the total dollars available will be more than last year, I think the compression will hurt retail the most. With less time, that means the shopping experience will be more crowded, so people will opt to shop online. Even though online will see a surge in demand, current eCommerce infrastructure can handle it. I have seen retailers pulling deals earlier, which I think is very smart. Still, it is imperative that the in store experience is as good as possible with less time. I strongly believe the experience of retail shoppers early on will dictate how successful retail is overall.

A final thought, Black Friday continues to fall as a share of November retail sales, maybe because of the crowds?

Apollo Bagels website

Summary: Apollo Bagels is a bagel chain founded in NYC by the founders of 7th Street Burger and Leo’s that has only bagel sandwiches

My Take: Bagels are clearly having their moment, as the readers of this newsletter are well aware, I think Apollo, though while under the radar has a huge opportunity as the sandwiches drive bigger baskets.

Founder(s): Joey Scalabrino, Mike Fadem, Paras Jain, and Kevin Rezvani

Funding: no publically announced fundraise

Number of Locations: 2 Open (for now) in East Village and West Village, 2 in development in Jersey City and Williamsburg

Social Media Following: 34K on Instagram and lots of UGC on Tiktok (no brand account though - seems like a missed opportunity)

Additional Links:

Another alternative channel to watch: the skies - Shake Shack and Delta announced a partnership where you can get Shake Shack on certain flights (read more here)

At the end of the day, most money is spent on retail rather than DTC and sometimes we all need that (read more here)

Founders upside for having a retail business be purchased in huge (read more here)

Craveworthy Brands acquired better for you pizza concept, Fresh Brothers, and is planning to launch franchising (read more here)

Advice for how to succeed once you finally land that retail account - the work doesn’t stop there (read more here)

Tatte opens location number 42 in Hingham, MA (read more here)

McDonalds to launch new value-focused menu that showcases value nationally (read more here)

Chipotle now has 1,000 locations with a drive through and is on pace to open a record number of units (read more here)

Walmart tries to grow eCommerce share by being the most convenient option to win more higher income households (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.