Issue #30: The Untapped Corporate Gifting Market

Before I dive into the newsletter, I just want to start by thanking everyone for following along the journey thus far. When I started this newsletter, I had hopes for what this could turn into and it has surpassed my wildest expectations. The response to this newsletter has been amazing and I am truly grateful for every subscriber, interaction, and more! I am very proud to reach the 30th issue (and all in a row!) and excited to continue the rest of this year and beyond! This will be the last news issue of the year, but don’t fear, there will be more content this year! I will be writing a “Retail wRapped”, a la Spotify Wrapped, edition summarizing this year and previewing next year - so keep an eye out for that!

I have a lot of plans for next year and am excited to share more as my ideas become reality. The first initiative I want to share - connecting subscribers more frequently, real-time. I am planning to launch some sort of group chat next year where subscribers can discuss the latest trends. If you are interested, please respond to the poll below “Yes” and spread the word! This chat will only be for subscribers, so if there is anyone you think would be interested, please make sure to send them the link to subscribe!

Each year, companies in the US spend roughly $300B on gifting, with most of it going towards gifts for their employees and clients. One of the most gifted items was alcohol, as I saw firsthand in my prior role as Chief of Staff at Coasters. Coasters is a 3PL for alcohol, where we owned and operated liquor stores focused on eCommerce, particularly shipping. These orders were primarily gifting related, in particular from corporate gifting. One moment that stood out to me in particular early on in my tenure there was a huge corporate gifting deal we did with a corporate company to send gifts to their 1000s of employees, which also opened my eyes to the opportunity in the space. Throughout that process, one late night, while packing orders to make sure they got there in time, I started to think through how more companies could be involved in this. We went on to continue to leverage this line of business as a growth lever.

I strongly believe more businesses need to take advantage of corporate gifting as a growth channel. Here are the top 5 takeaways and processes I wanted to share as best practices I have seen/learned from mistakes over the years.

Create a semi-customized/personalized product - different enough from your existing offerings to be special, but not different enough to be too much of an operations headache

When determining how to approach the company from a sales perspective, first answer this question: “Does Company X have an existing corporate gifting program?

If the answer is “Yes”, the best way to approach it is by going to the people in charge of the program and pitching them on your service. The people often in charge of these programs are in HR, People, or Admin (typically for senior executives)

If the answer is “No”, the best way to approach is by going directly to the senior leaders, who will need to approve this program and the budget.

Do your work early - oftentimes the companies will wait to approach this at the last minute, but make sure they hear about you early

Specialized packaging is a double-edged sword - people want it because it looks great but needs significant advanced time to execute and is expensive

Collaborate with other brands/vendors to help add perceived value to the gift

Bonus - don’t be afraid to leverage your network to get leads and collabs

On top of these strategies to pursue on your own, there are marketplaces that work to get clients just for corporate gifting. Here is one list of these marketplaces and there are many others out there too. Highly recommend getting your products listed there as many integrate directly with Shopify too for pure incremental orders. Another call-out - been loving what Feast and Fettle have been doing to get the word out on their product for corporate gifting.

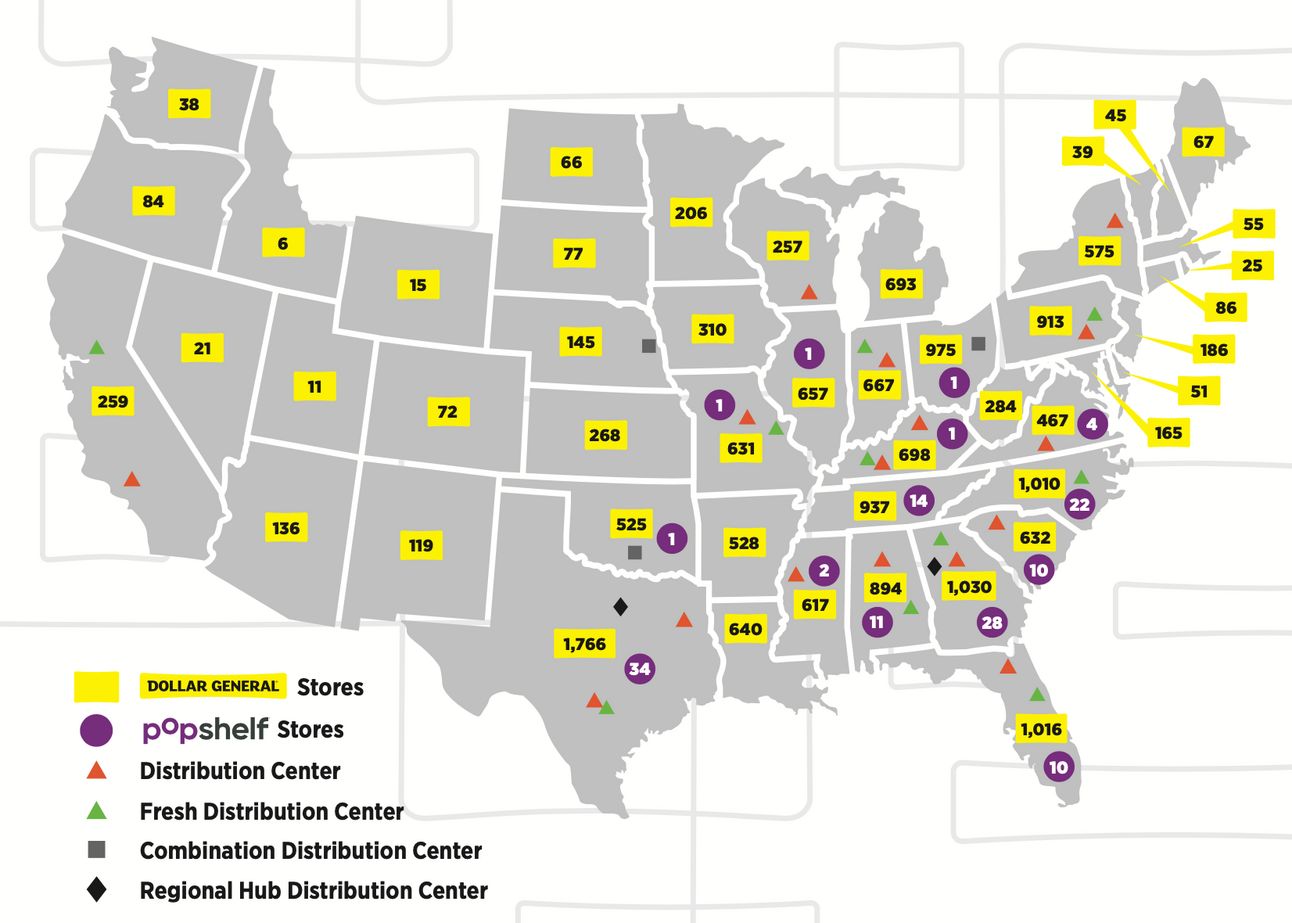

Dollar General Re-Works 2025 Strategy

Dollar General began as a discount store selling dry and non-perishable goods in rural areas for a dollar (hence the name). Approximately 80% of those stores are in areas of 20,000 or fewer people, which means there aren’t many opportunities to purchase groceries without traveling a far distance. Dollar General noticed that gap and has since been adding a fresh grocery assortment to its stores. From 2022 to 2023, Dollar General added produce to more than 1,800, and now by the end of 2024 has over 7,000 locations that sell produce, out of the roughly 20,000 locations it has. The plan is to continue to add produce to its locations, however, the pace is going to slow next year to only about 300 additional locations gaining fresh produce. Instead, the plan is to accelerate the pace of remodeling stores, by doing planogram optimizations, expansions across the store, and updating physical assets in the store. The hope is that this will help stores continue to grow, and already some of the reworking is helping, as Q3 same store sales increased 1.3%. For a retailer that has been struggling with its identity and value over the years, it seems that they are finding some aspects to grow further. I am very bullish on these remodels and excited to see the continued emphasis of grocery to help build bigger baskets.

Upper West Side Institution Absolute Bagels Abruptly Closes

On Thursday, news started to circulate that Absolute Bagels was closed, and walking by, you could see the shutter down with hastily typed we are closed signs taped on it. There was confusion around what happened in the ensuing days, as the store was not communicative about what happened. However, given all the outcry, the NYC Health Department stepped forward and offered an answer. According to them, the store was forced to be closed due to posing an “imminent health hazard.” Some examples of issues include live rats, unsafe chemicals, faulty food storage, malfunctioning sewage systems, and bugs. Not a great combination for a food establishment. However, these are all issues that can be fixed, but would require some extensive investments to make the food safe to consume. Weighing those costs and benefits, the store owner, who has not really said anything publically, decided to shut everything down. A broker has been engaged to fill the space - maybe an opportunity to reopen under another owner? Still, a sad part of retail is when the institutions close, but keeping basic health codes up to date is a major part of being a restaurant. A story to continue to follow as more information comes out.

Lululemon Post Strong Earnings

Thought Q3 earnings season was over? Not yet! This week Lululemon posted strong earnings, after having struggled over the recent quarters. Revenue increased 9% and net income 42% for the quarter, which was the strongest this year so far. What is driving these turn around? The simple act of prioritizing the actual Lululemon customers and making sure the experience actually spoke to them. Over the recent months, the assortment has been tweaked and better stock is being kept of the sizes that sell. On top of those changes, the crucial piece was that these changes were able to be implemented super quickly, ahead of a big holiday season. The changes are continuing to pay off, especially given Lululemons’ omnichannel nature. According to CEO Calvin McDonald, who has a background in retail at Sears and Loblaw (a large Canadian retailer), it had the most visits ever to its app and e-commerce site on Black Friday. In terms of retailers I am keeping my eye on to have a bounce back 2025, Starbucks is definitely #1, but Lululemon is not too far behind.

Orange Theory’s Largest Franchisee Declares Bankruptcy

Unbeknownst to me, Orange Theory, the boutique fitness class studio, is actually a franchise. In February, it was announced that the parent company was going to merge with Anytime Fitness’s parent company. On paper, this merger seems to make sense as the two concepts are pretty complimentary, as Anytime Fitness is more of your traditional gym rather than a studio. However, it does not seem like the synergies have gone into place, as Orange Theory’s largest franchisee, Honor’s Holdings, declared bankruptcy due to cash flow issues and falling profits (from an average per studio of $300k in 2019 to less than $150k in 2023). The biggest problem here is Orange Theory’s identity crisis, a similar problem that many others face. Is Orange Theory a product or just a feature of that? What I mean by that is that it is unclear if Orange Theory can function on its own as a stand alone brand with its current value proposition, like a Soul Cycle, or need to be part of a broader gym, like how Spin classes are part of other gyms. Right now, Orange Theory just does not have much value relative to its brand. Its cost is around $200, which is around what many premium gyms, like Equinox and Lifetime charge for classes plus full amenities. If those are your options, why would you choose Orange Theory? Plus, the product is very stale and consumer attention spans change frequently. I think the further integration into Anytime Fitness will be beneficial, but the challenge will be from a space utilization perspective. Will they integrate it into existing Anytime or will it be just a joint membership? If they integrate the two properties into the same space, what will happen with all the existing Orange Theory spaces? It will be something to follow next year.

Summary: Le Alfre is a premium menswear brand with modern takes on classics designs selling on both eCommerce and their retail location in SoHo.

My Take: Americans spend over $350B+ on clothing and it is one of the most frequent items purchased online. However, as part of the great returns reckoning we are seeing, and I expect to see continue next year, retail is going to be a huge part of the growth of apparel as that is such a sensitive item.

Founder(s): Brandon Snower

Funding: Unkown

Number of Locations: 1 (SoHo)

Social Media Following: 27k on Instagram and 32k on TikTok

Additional Links:

Amazon now sells cars on its platform, starting with Hyundai (read more here)

Starbird, the California based better for you fast food chicken chain has added more franchisees in Washington and Denver (read more here)

The Kroger and Albertson merge is off (read more here)

Marks and Spencers, the British grocery store, was struggling but now is on the come back (read more here to find out how)

After popular pizza place, L’Industrie, was forced to remove its outdoor seating along with many others, they tried to get creative by parking a renovated bus in front of the store, but that has been shut down too (read more here)

With many large convenience stores shutting down locations over the years, there may be as much as $6B in additional spending up for grabs (read more here)

Doordash is now delivering bridal items (read more here)

L.L. Bean announces layoffs of its corporate staff after declining sales (read more here)

Shoppers are on track to return $890B in merchandise this year (read more here)

Macy’s announces more store closures that will happen fast as it tries to get back on track faster (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.