Issue #33: Bowls, Salads, Wraps & More

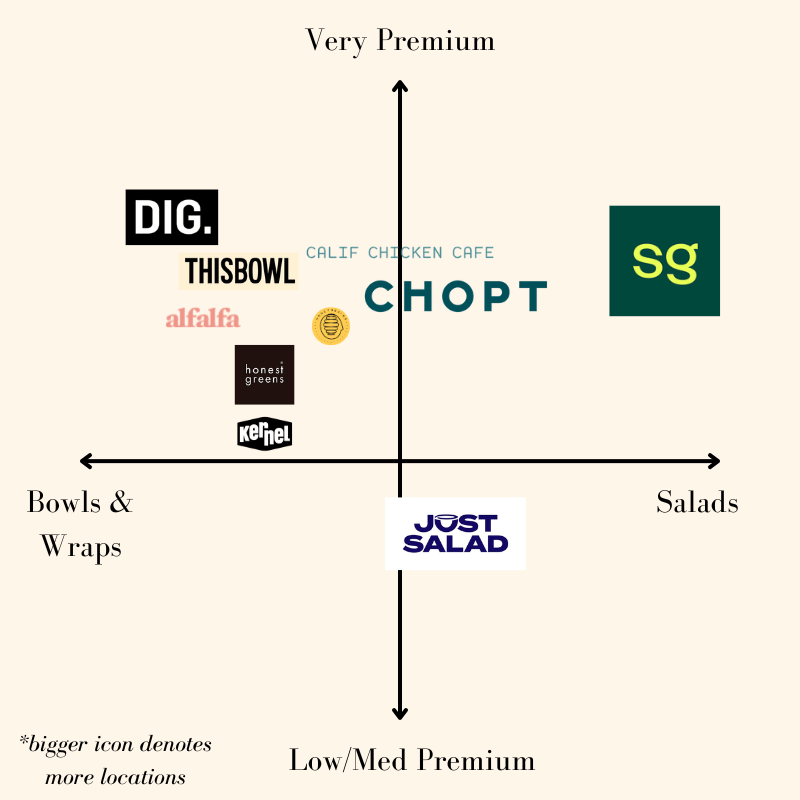

Market map of some of the fast-casual spots I highlighted in the piece

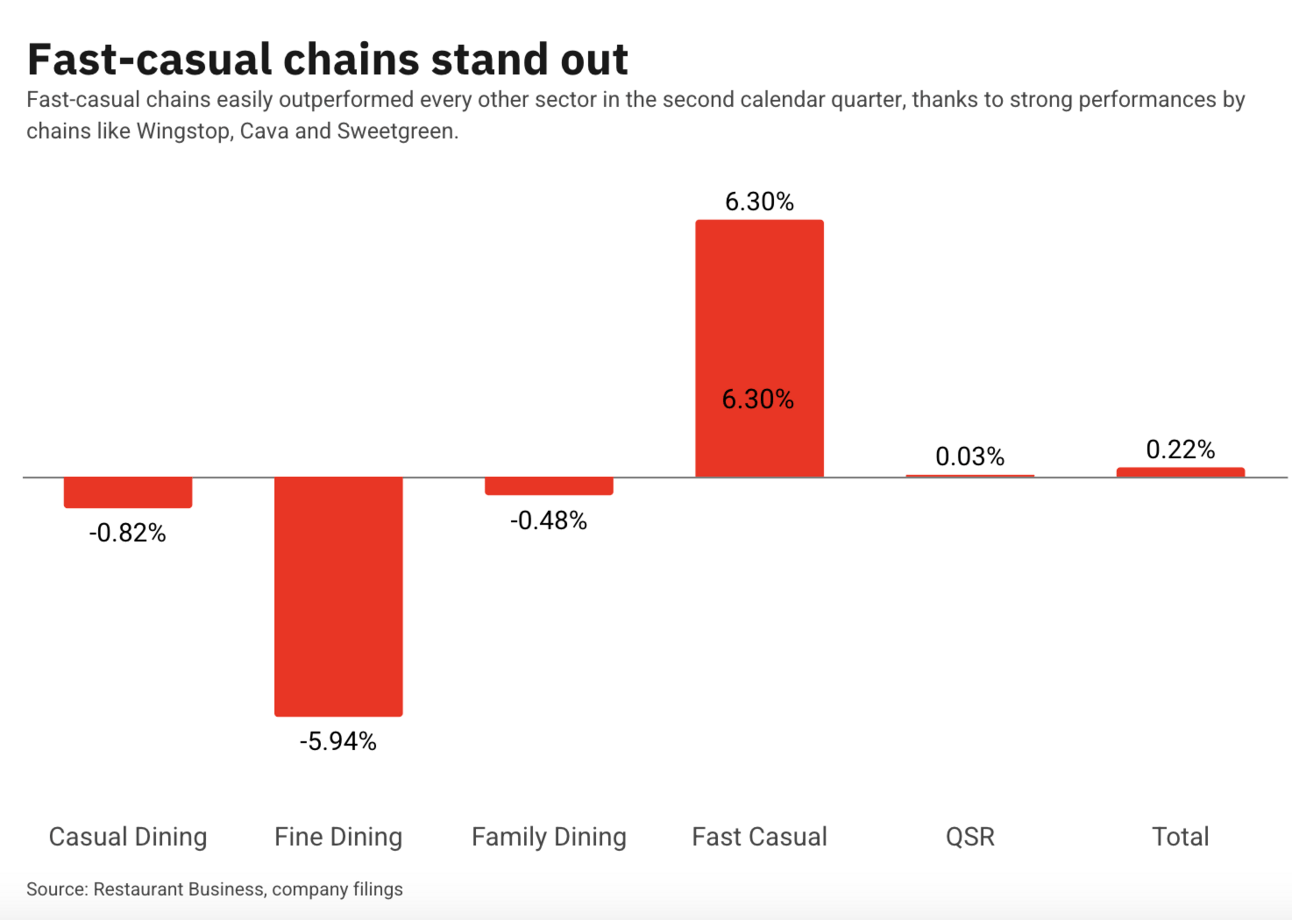

Fast-casual restaurants have exploded in popularity since Chipotle was founded in 1993, with most of the growth occurring post-Great Recession in the mid-late 2010s. Customers appreciate the quick service of healthy food, and the customizability of the food. So much so that they are willing to pay a hefty premium. Right now, the undisputed leaders in the space are two public companies, Chipotle (3,500 locations) and Cava (375 locations). The space is currently experiencing rapid growth currently in time when most other restaurant categories are declining. Here is a great graphic summarizing Q2 2024 growth by restaurant categories.

The continued growth despite the broader industry struggles is not the only reason I am excited about this sector. The product is generally very high quality and these places attract a very premium/sought after wealthy customer demographic, while still not being too expensive to attract less wealthy demographics too. As I have mentioned in the past two issues, I am on a quest to find the next great fast-casual restaurant, that can match Chipotle and Cava in eventually reaching 1,000+ locations. In particular, I am looking for a hybrid bowl/salad/wrap (maybe a sandwiches too?) where they have a super strong digital presence, scratch cook most ingredients in the store, and prepare the food on a line in front of you. I really like the ability to cater to the lunch and dinner crowd, especially for offices. Instead of diving into one mega-issue this week, I wanted to take time to highlight ten of the interesting players in the space. Who will win? I am not sure yet, but excited to follow along! Also, if you have any favorites I missed, be sure to shoot a reply here? Here we go, ordered from most locations to least:

Sweetgreen (230 locations) - Sweetgreen is the leader in the space and arguably the leader in the “rest of the fast-casual pack” and the company that could capitalize the most. Sweetgreen offers bowls and salads, but not wraps, presently. However, I am not fully confident Sweetgreen will emerge due to its inability to be profitable. Since going public almost three years ago, it has been on a profitability quest, but it has yet to turn profitable even for a quarter. Sweetgreen is heavily relying on automation to fix its cost structure, but that is expensive and difficult to retrofit. The product quality and cult following are there, so I would not be shocked to see it reach 3-400 locations, however, to hit 500 plus locations will be tough.

Chopt (~103 locations) - Since its founding in 2001, Chopt has been growing at a slow and steady clip. Offering bowls, salads, and wraps, Chopt has a very wide menu with limited ingredients, which is great. I also really like how they have focused on a limited geography, mostly in the northeast and mid-Atlantic, unlike Sweetgreen who scaled nationally quite early. This focus allows them to build up economies of scale and cost efficiencies before moving to bigger locations. However, I think its biggest challenge is also the differentiator from other places. Chopt offers chopped sales, where they chop up all the pieces small, which adds a fun twist to the salad, but increases labor.

Just Salad (90 locations) - Similar to Chopt, Just Salad also offers bowls, salads, and wraps. Also, similarly, it is concentrated in the Northeast, in an effort to build up similar economies of scale to Chopt. However, unlike Chopt, they do not have the chopping of the product. Additionally, Just Salad is less premium than its two competitors, which could be good and bad. If they win or lose, it is because of this less premium concept.

THISBOWL (46 Locations) - THISBOWL is a newer player on the (United States) scene, having amassed 45 locations under the FISHBOWL brand in its native Australia and just opening its first US location last year in NYC. It features Japanese and Australian hybrid bowls or salads with proteins, veggies, dressings, and crunches. Since launching in NYC, it has gone viral on social media and lines are around the block. There have not been expansion plans publically announced yet, but I am strongly assuming those are on the horizon. After all, they raised money from Stripes Group, and as readers of this newsletter you have seen how fast its other portfolio company PopUp Bagels has grown since receiving investment from Stripes (make sure to stay tuned for a PopUp Bagels update).

DIG. (33 locations) - Out of all the locations covered so far, DIG. is the most bowl-focused and most premium. They have salads, but the focus is mostly plates/bowls. What I really like about DIG, aside from their unique focus on bowls, is the way their menu has been constructed to focus on catering and families. You especially see this while browsing their website and app. Plus, their food quality is amazing, which makes sense given its origin from the DIGINN restaurant.

Honest Greens (30 locations) - Another non-United States fast-casual restaurant, Honest Greens is based in Barcelona with additional restaurants across Spain, Portugal, and London. Honest Greens features a variety of better-for-you bowls, salads, and bread dishes. Unlike most of the others on this list, they also serve breakfast. For the quality of the food, it is priced pretty reasonably. Additionally, they just received funding from Act III Holdings, the investment firm of Ron Shaich, founder of Panera Bread and current Chair of Cava, Tatte, Life Alive, and Level99. Not a bad investor to have in your corner. Would imagine a United States launch is coming soon too, probably in Boston or NYC.

Calif Chicken Cafe (13 Locations) - Unlike the other fast casual establishments mentioned on this list, Calif Chicken Cafe is West Coast focused and has been around for a while as it slowly expands. It offers wraps and bowls, with a specific focus on chicken. Given the rise in all the fast-casual/fast food chicken places, this is a good healthier, foil to them. However, given its founding in 1991 and its current state of 13 locations, it is hard to imagine reaching 1,000 locations. Out of all the establishments on the list, this one could be the most primed for an injection of growth capital.

Alfalfa (7 Locations) - Recently featured in Issue #31, Alfalfa is a is a better for you salad, wrap, and bowl fast casual restaurant, that also serves donuts. The ingredients are sourced locally and the idea is that they will be better for you. Interestingly, the locations are split between New York metro area and California. For a small chain, that is a reality, but it will be interesting to see what the go forward plan in terms of location footprint is from here.

Honeybrains (4 Locations) - Also covered recently, in Issue #32, Honeybrains is a better-for-you-focused fast casual place. They are similar to all on the list, except they serve breakfast and are very health-focused. So much so that they have a nutritionist on staff. I am skeptical there is that big of an audience for healthy foods. However, they have been able to keep prices low so far, which is a win, and if it can continue to keep prices low could be a major win win to pair healthy food with a not too premium price.

Kernel (0-2 locations) - Kernel was the second startup I ever featured, in Issue #2, and it suffices to say it has been an interesting journey for the company since. What started as an almost fully automated vegan/vegetarian bowl concept, now is temporarily shut down to accommodate changes. However, they are anticipating opening again. This time with a different ethos in some ways by adding meats because customer demand for no meat was not there, as most people are more flexitarian. Once it re-opens, if they are able to nail the concept, you can expect rapid scaling due to the funding already raised, as well as the automation scalability.

Overall, I would highlight THISBOWL, DIG., and Honest Greens as some of the concepts I am most excited about. However, one sneaky concept could be Calif Chicken Cafe, if they were able to secure the proper capital stack.

What did you think of the market map format rather than a big trend?

Retailers Try to Keep Up With Endless Aisle

For a while now, retailers have been turning themselves into marketplaces to try and compete with Amazon. Some examples of retailers that have undergone this path are Target and Walmart. Technology startups have also sprouted up to help service. This week HBR wrote an interesting deep dive on why retailers are doing this, more from a negative-ish slant, rather than what can be improved. However, I disagree with that assertion as it is definitely a necessity for these retailers to get involved and there is a playbook for doing this correctly. Digitally, you need to have an endless aisle or be super curated. A traditional big box brick-and-mortar will never be curated online. The core problem is that being a marketplace requires technology and investment. It is not a quick shortcut to incremental revenue. Look at Amazon where most of the eCommerce orders are not really making money. Most of the profit is off the Prime subscriptions and AWS. So what do retailers need to do to compate? Short term, run it as close to breakeven as possible to invest in the experience and ops. Long term, that will pay off and margins can grow because there are a lot of upfront fixed cost. It will also help cement a reason to shop in person. Not the most optimistic outlook, but I think there is a definite reason to be investing.

Another Food Hall in NYC Closes

Remember when food halls were all the rage? Multiple concepts all in a confined space with seating and amenities. You could order from all them on delivery too. However, despite the concept doing well on the surface and people being interested in theory, in practice, these have not been utilized. This week it was announced Citizens Market Hall at West 33rd and Ninth Avenue would be closing shortly. In the past couple of months, Gotham West Market, Williamsburg Food Hall, and the Market Line have closed. One trend I have noticed is that the ones hurt the hardest are located in office buildings or areas dominated with office building, which makes sense given the reduction in office time. I also think from a real estate perspective it is hard to make it work. Going forward, I think you will see more like Wonder and Local Kitchens, which have had their own issues too, are the way these food halls will operate. Multiple restaurant concepts under a normal sized restaurant square footage, and most likely more premium than those concepts. I am still bullish on food halls going forward, but the strategy has to adapt.

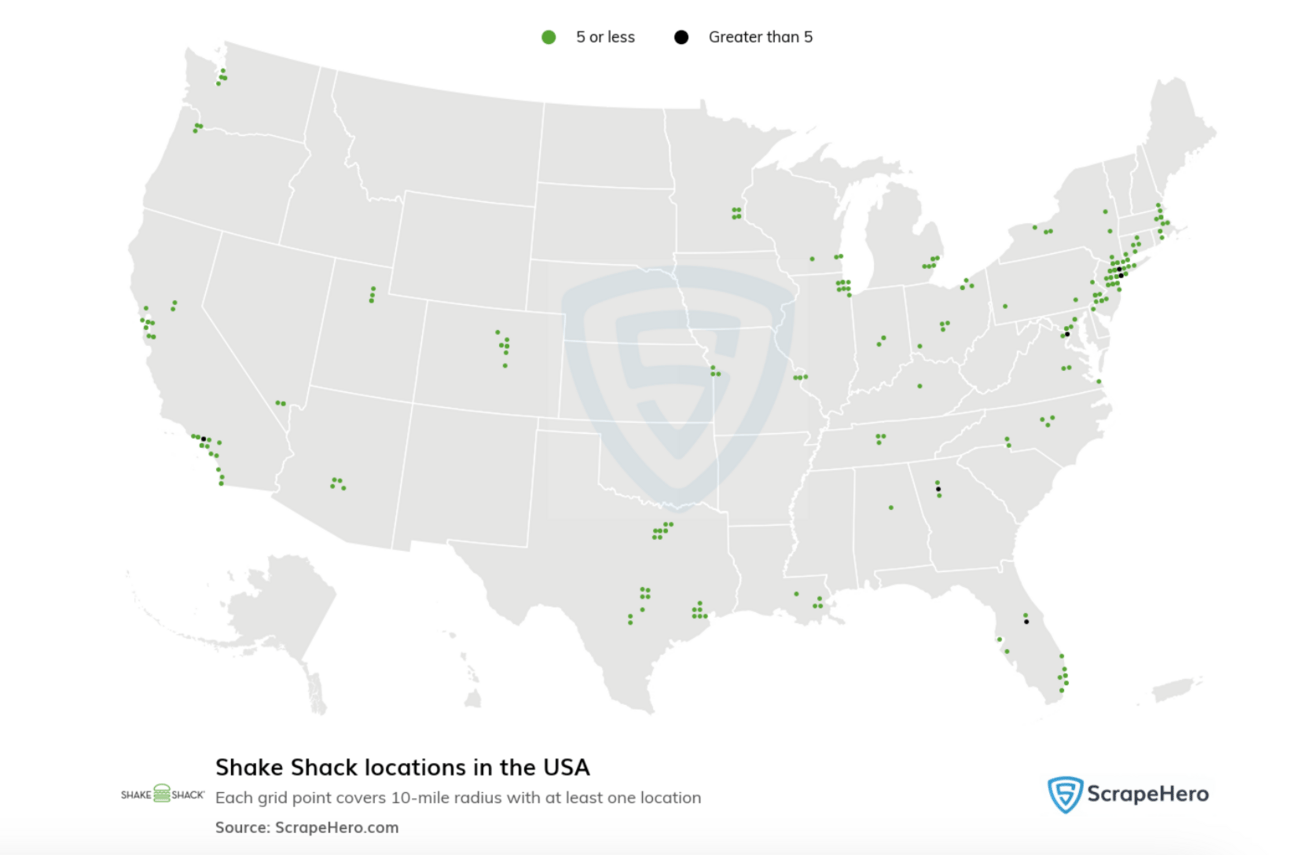

Shake Shack Preliminary Earnings & Expansion Plans

Exciting news in the fast casual world, burger chain Shake Shack founded by Danny Meyer as a cart in NYC released preliminary Q4 earnings this week and they look good. Same store sales up 4% YoY, revenue up ~15%, and restaurant margin up 300 basis points YoY, and adjusted EBITDA up 48%. Not too shabby and you can see why they want to expand. Currently, it has ~500 locations, with ~300 in the US. The plan is to 3x that to ~1,500 locations. Most of the current locations are located in major metros, where there is still room to grow, so it will be interesting when they decide to expand beyond that. After all, what really propelled Chipotle’s growth was expansion to current heights was expansion beyond the metro areas.

Turns Out Locking Up Items Is Bad For Business

Like many other convenience stores, Walgreens locked up high-value, small items to combat theft. Predictably, it has led to decreased sales, according to their CEO, who lamented this issue publicly. However, he did not indicate whether this strategy was ROI positive. Did sales fall more than shrink was reduced? What is the dollar savings? While those details would have been helpful, that is not why I bring it up. From my experiences in retail, I believe this strategy is misplaced. There is definitely the unfortunate need to lock up certain items without a doubt. But, accompanying these items being locked up has been a decrease in labor investment at these stores, partially due to difficulties hiring, partially due to reductions in labor spending strategically, among other factors. This means, which I believe is the core problem, it takes forever to get the item unlocked. If there were decreases in shrinkage due to locking up items, they could be invested into additional labor to make the customer experience better. It shouldn’t take 10 minutes to unlock a cabinet, which happens all too frequently. I believe the core of this sales decline is the lack of investment in labor. With more people on the floor, interacting and greeting customers, you will decrease shrink and improve customer experience, regardless of if items are locked up. You would be presently surprised how much having friendly employees walking around interacting with customers does to decrease shrink. Additionally, the labor decrease has been felt across the supply chain, which leads to increased administrative errors and other types of non-transactional shrink. For instance, a store doesn’t have the time to properly receive the inventory they ordered to realize they got less than they ordered, which causes errors that make it seem like items were stolen. I strongly believe these stores should invest the savings from shrink prevention into additional labor throughout the supply chain, and step back to see customer satisfaction skyrocket.

Additional Links:

PopUp Bagels opens first franchise in Boston, shortly launching additional franchises in DC and Boston (read more here)

Popular Brooklyn bakery L’Apartment 4f announces that it will finally open its West Village location on February 1st (read more here)

Seed oils are all the rage right now and here is a great market map on how to navigate the space from the investors in one of my favorite oils - Alage Cooking Club (read more here)

The rise of vintage and retro retail, from mass market to curation (read more here)

TJMax’s growth is cannibalizing Marshall’s, as well as hurting Ross (read more here)

TikTok Shop won the holidays and more details on who won here

Amazon planning to lay off 200 people in retail ops (read more here)

December retail sales outperform expectations, grow 5.6% (read more here)

Joann’s files for bankruptcy again after filing for it in March 2024 (read more here)

Sephora plans to renovate all of its 700 stores in North America (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.