Issue #37: Mobile Ordering Takes Off

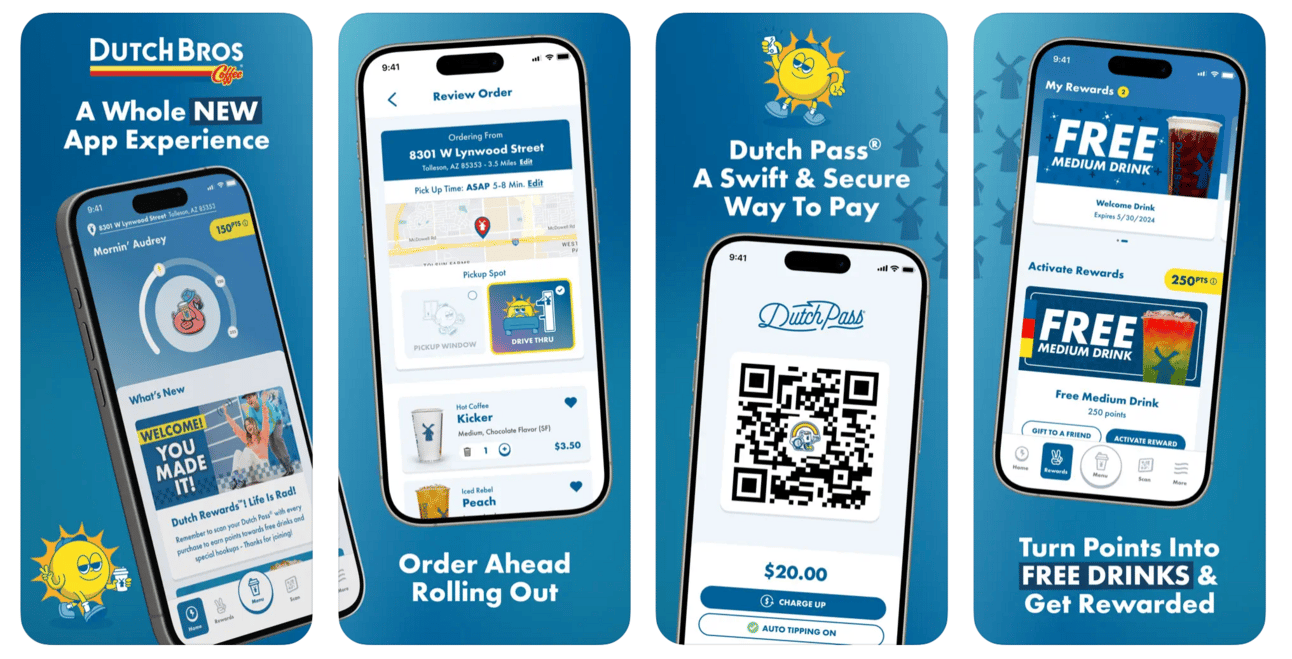

Dutch Bros Mobile App (Most of which are pickup orders)

This weekend, I once again had the fortune to go skiing, albeit in Northern New Hampshire this time. In addition to being a retail nerd, I love bakeries, so naturally, I have to scope out the best one in an area. On the way to the mountain, luckily, is one of my favorite bakeries in the area. It’s a small place that produces some amazing pastries and breads. However, given that it is a small place, and it is not the most efficient fulfilment setup, sometimes you have to wait a little. I am okay with a little wait, but understandably, some people are not as patient. So, instead of waiting in line, they pick it up with an order ahead. Today, as I turned over to the wall, there was an entire bakers rack filled to the brim with pickup orders, many of which were from mobile devices. The online ordering fulfillment experience is seamless for the bakery too, as it is integrated with the Toast POS system they use. Plus, they can pre-pack these orders to get ahead of the rush. A win-win! The couple $1,000s of daily sales that come from this pickup option is clearly priceless and go a long way to boosting the bottom line.

Vintage Baking Company is not the only one benefiting from the boom of mobile, pickup orders. Across the country, on the West Coast, a slightly larger retailer, beverage retailer Dutch Bros’ has seen its sales skyrocket. This week, it reported on the Q4 2024 earnings. Dutch Bros’ same-store sales rose 6.9% and transactions were up 2.3% in Q4 2024, marking its strongest quarter of transaction growth since 2022. What was the main driver of growth? The mobile ordering that was launched less than a year ago as a test. After rolling out to 96% of the locations this quarter, it now already represents 8% of sales. Not bad for one year in, and only a quarter of full roll out, but for some context Starbucks is up to 70% of sales originating from its mobile app. Smartly, there is also a separate walk up window at these stores already, where the pick-ups can happen. According to the CEO, most of the mobile orders tend to be pick-ups. After all, waiting in the drive-thru takes time, so why order ahead and go to the drive thru to pick it up? It has not significantly impacted its operations, which is great, unlike Starbucks.

For any retailer, it is clear that mobile ordering, as well as pickup, is the path forward. But, how do you navigate this change? First, it needs to be forefront when starting a new retail. If the location is not new, there needs to be retroactive segmenting in the location. You need dedicated labor to mobile/delivery, otherwise either those customers will feel neglected or your in person customers will. There is not the need to bring in additional labor overall for the most part, you just need to be cognizant of making sure all customers are happy. That is the omnichannel world we live in! Another strategic shift for retailers to navigate.

Netflix’s new restaurant in Las Vegas

Netflix Bites: Vegas Edition

After a successful restaurant popup in LA in 2023, and a permanent location in the King of Prussia Mall outside Philidelphia (Check out Issue #5 for more details), Netflix has decided to launch another popup restaurant. This time, the restaurant will be located in Vegas and last for a year, instead of three months. It will be inside the MGM Grand Hotel and Casino. The menu features favorites from hit shows like Squid Games and Bridgerton, and will revamp the menu along side the new shows it is releasing over the next year. Netflix clearly sees the ROI in the physical locations, otherwise it wouldn’t continue to launch these. For brands with a digital presence and loyal following, it is a good model to see the benefits of creating limited, one off, pop-ups to delight the fans. People want to interact with digital experiences in person too, and it seems that these types of experiences are here to stay.

KFC Hires New President

Amid struggles that see same stores sales declining 5%, KFC is searching for answers. The broader fast-food chicken market, like Dave’s Hot Chicken, has been crushing it, so the issue is isolated to KFC. KFC needs to respond otherwise Yum Brands flagship retailer may be left behind. However, they are not sitting idly by. First, it replaced the President of the US Division by promoting the CMO of the US division. This move elevates a 10-year veteran of the company who has experience in the international markets, which are KFC’s strongest geographic areas, and marketing, which is needed to boost its foot traffic. I think it makes a lot of sense to make this shift. On top of changing personnel, KFC is also incubating a new concept, Saucy. Saucy is slightly different than KFC, where its menu contains fancy beverages, chicken sandwiches, and chicken tenders with dipping sauces. Saucy is evolving KFC in a world where preferences are shifting with regard to fast food chicken. It will be exciting to follow along to see if the new President expands Saucy beyond its pilot location in Orlando. For a great breakdown of the new Saucy concept, check out this podcast from Matt Newberg and Brandon Barton.

Foot Traffic Increases in NYC Central Business District

In many cities and highways across the country and world, to use them or enter them you have to pay a fee. For the past couple of years, New York has been figuring out how to enact a congestion pricing toll to enter the lower part of New York. In early January, the law was officially enacted. So far, early returns have seen traffic decrease, subway ridership tick up, and regional commuter rail traffic blossom. However, it has been a little early to see the overall returns from a more financial and business perspective. That changed this week with the initial foot traffic numbers being reported. According to Economic Development Corp data, more people visited the area than January 2024. One of the concerns of implementing congestion pricing was that it would cause a decrease in foot traffic. So far the opposite is the case. It will be interesting to see both in NYC and the areas surrounding if this trend continues!

Launderette’s website advertising its services in NYC

Summary: Launderette is an NYC-based laundromat offering a variety of services including delivery, self-service, and commercial. In addition to walk-in transactions, you can utilize the app (mobile ordering!!!) and website to complete your transaction.

My Take: Laundromats have been around for a while, and they are not going anywhere either. However, they are typically lower technology than many other industries and usually don’t have much of a brand. All of that is usually due to the low margin of the business, but there is definitely room for premium options that can still make strong margins.

Founder(s): Ireland McCaughey and Benjamin Razin

Funding: Unknown

Number of Locations: 1 (Brooklyn)

Social Media Following: 574 on Instagram and 134 on TikTok

Additional Links:

Retail sales decreased 0.9% in January, which is down much more than expected (read more here)

Many restaurants are realizing catering is a huge unlock to additional revenue (read more here on the state of catering)

Uber sues DoorDash over exclusive contracts (read more here)

Stussy, the streetwear brand, is opening a new location in a SoHo apartment building (read more here)

7/11 is trying to expand its food service options in 2025 (read more here)

Joann to close 500+ stores after not finding a buyer (read more here)

California Pizza Kitchen is trying to reach more customers, so it is turning to vending machines and airport locations to meet customers where they are (read more here)

A look into how Lego tailors its in store experience to give customers the best experience (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.