Issue #4: Movie Theaters Are Back?

Trend of the Week: Sony Acquires Alamo Drafthouse

Upscale movie theater Alamo Drafthouse serves food and drink

This week, Sony Pictures, famous for producing movies like Karate Kid, Ghostbusters, Spiderman, and other classics announced they were acquiring upscale movie theater chain, Alamo Drafthouse. Headquartered in Austin, Alamo Drafthouse has 35 locations across the country and is known for comfortable seating and an elevated food and beverage menu compared to your typical movie theater. This purchase is the first time a large, incumbent Hollywood studio will own a movie theater chain since 1948 due to a Supreme Court case that produced the Paramount Consent Decrees, which forced the sale of movie theaters from major studios, similar to the three-tier system in alcohol. In 2020, this decree was terminated due to the evolution of the industry and the Covid-19 pandemic. Since then, Netflix bought LAs' Egyptian Theatre and NYC's Paris Theater, and Amazon bought ArcLight in LA, but no major legacy studios have bought a movie theater since the decree was lifted.

Why is this a big deal? Movie theaters were once a core part of retail, but with declining attention spans, the rise of streaming (people would rather wait to watch on streaming than in theaters), and the popularity/increased availability of television shows, demand for going to see movies decreased. This shift in preferences has caused many theaters to close, which is a problem because many were part of a larger retail area. Now, a draw to come to that retail area has evaporated. However, consumers are still looking for experiences, and some theaters have adopted by reducing the number of seats, allowing you to book your seat ahead of time, making seats more comfortable, and expanding food and beverage menus. I am very bullish on this move by Sony as now for their films they can create better experiences that give people a reason to see it in the theater, and maybe even charge more for the tickets for those experiences.

Omsom website with fun branding and personal touch from founders

News of the Week:

Positive:

Omsom Acquired By DayDayCook (DDC) - Omsom, the startup founded in 2020, known for making Asian noodles and sauces with bright, colorful branding was acquired by DayDayCook, a Hong Kong based food company that specializes in ready-to-eat food. Already in their portfolio, DDC owns Mengwei (hot pot) and Yujia Weng, Chinese seafood. Last year, they acquired Yai’s Thai (sauces) and Nona Lim (noodles and broth). Omsom capitalized on a couple of trends to suceed. First, consumers want better options for Asian American food. Second, consumers want better for you ready-to-eat foods (just look in any cart in Trader Joe’s). Third, they emphasized retail. Retail continues to be a strong channel for them and other successful emerging brands. In the press release announcing the acquisition, they announced Q1 grocery channel revenue was up 324% (unclear how much is from new stores they are in) and they have now reached over 100,0000 customers in over 2000 stores. Additionally, Omsom was excellent about using their voice to build a founder led brand, social media marketing, and combining retail and D2C to scale. Pretty impressive - don’t sleep on retail!

Instacart x New York Times Cooking - Many startups have launched to make recipes more shoppable (I wrote more about space here). This week Instacart announced a partnership New York Times to embed purchasing within the content, which is one of the most high-profile partnerships in the space. A click of a button takes to to a page that will add all items to your cart. Additionally, they are using it as a mutual opportunity to grow users by offering Instacart users a NYT deal, and vice versa. It’s a natural partnership since customers will already be wanting to purchase ingredients for recipes they want to make. However, people generally purchase groceries for multiple meals, not just one. The challenge to getting people to use it will be building it into the flow of their whole basket purchasing. Still, I believe this is a big opportunity to combine content and commerce in the food space in a way that hasn’t been done before.

While browsing the NYT cooking content, if you see a recipe you like, would you purchase the ingredients through Instacart?

Negative:

Nordstrom To Go Private? - Like many department stores, Nordstrom has had to adapt their model from a large mall-based model to a more e-commerce focused model. Nordstrom has been at the forefront of department store innovation by expanding the discount chain Nordstrom Rack, adding e-commerce focused Nordstrom Local (pickup, returns, alterations) locations, and building out a strong e-commerce website. However, due to the struggles of consumers and large company debt, it seems a change may be imminent. The original Nordstrom family, which owns around 30%, has been exploring taking the company private. This conversation has been going around since 2017, but picked back up recently. It is disappointing to see an iconic retailer struggle and, hopefully, the return to the founding family will help continue to bolster one of the few department stores that was innovating.

Startups Shutting Down Retail Storefronts - Direct-to-consumer brands raising significant capital and expanding to retail was a common trend in the early 2020s. A significant trend for these brands in 2024? Shutting down some or all of those retail locations and pivoting back to mostly D2C. Outdoor Voices announced the close of all 15 of its stores. Allbirds announced it will close 10-15 stores in 2024, part of which is due to their square footage being too large from the semi-failed expansion into apparel. These brands are not alone and I don’t expect this to be the only time this topic is broached this year. It is unfortunate that these brands, whose struggle at its core was not due to the retail strategy really, were unable to make retail work. However, I am very hopeful a next crop of retail startups will rise up and take their place.

Startup Feature: Bite

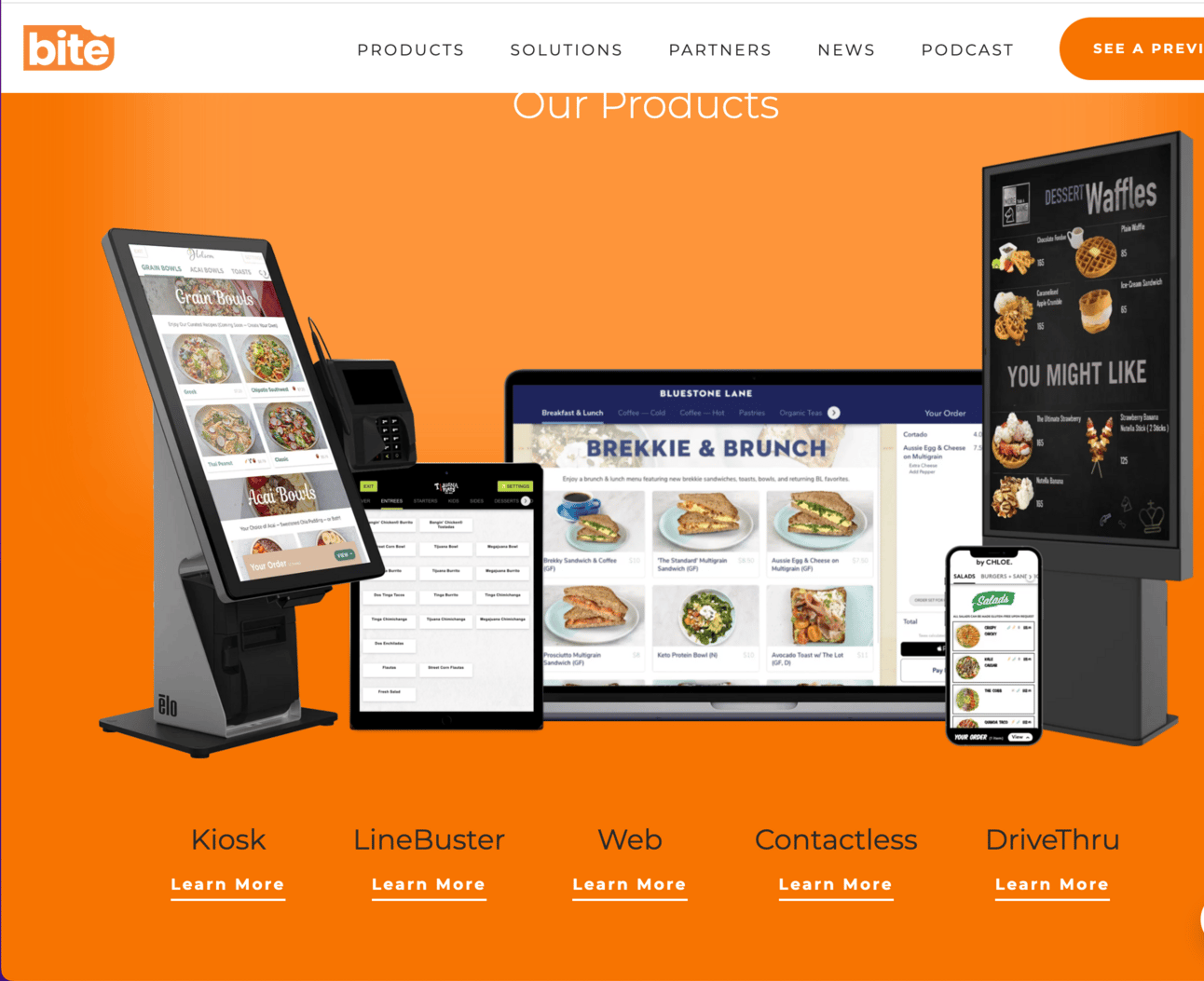

digital ordering options from Bite

Summary: Digital ordering software and hardware for restaurants

Founder(s): Brandon Barton, Stas Nikiforov

Amount raised & investors: $19.5M from Staley Capital, Tamarisc Ventures, Graham Partners, One Way Ventures, SOSV, and Branded Hospitality Ventures

How this will shape the future of retail: Fast casual and fast food ordering is increasingly less taken by a human and Bite offers many solutions to digitally order

My take: Labor is one of the largest costs and challenges in retail, and by augmenting with digital ordering employees can focus on making great food and delighting the customers

Job Opportunities:

Instacart | San Fransisco, CA - Chief of Staff to the CFO

Van Leeuwen Ice Cream | Brooklyn, NY - Real Estate Manger

Blank Street Coffee - Brooklyn, NY - Chief of Staff

Additional Links:

Snaxshot, a media company, launching a CPG popup in NYC (read more here)

Doordash expands alcohol delivery capabilities (read more here)

Prepared meal delivery company, PIKA, launches in NYC (read more here)

NYTimes dives deep into the rise of Asian grocery stores in the US (read more here)

Thrive Market adds new Chief Merchandising Officer (read more here)

RetailReady raises $3.3M to help make sure products being shipped to retailers are done compliantly with the retailer guidelines (read more here)

The details on the Omsom acquisitions (read more here)

Landlords and tenants balancing act to ensure long-term success (read more here)

Lovesac announces Q1 earnings (read more here)

Whole Foods latest store in SF is delayed further (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.