Issue #57: Is Frozen Food The Future of Retail?

Is Frozen Food The Future of Retail?

A couple of months ago, I completed the memoir of the founder of Trader Joe’s, Joe Coulombe. Right after completing the book, what stood out most to me was his expertise on the operations side, and this is what I attributed as a major key to his success. Recently, I saw this tweet below, and it has caused me to reflect on how Trader Joe’s was at the forefront of making frozen meals popular, a different angle than before. I knew I had to explore further.

In the index at the back of the book, frozen foods are mentioned on 13 separate pages, which seems to be in the top 10% of topics covered. Looking back through the frozen pages, a couple of things stand out:

Trader Joe’s first exposure to frozen products was on the seafood side, where they were the first to offer unbranded, non-processed frozen items

One of the first branded products they sold was a Wolfgang Puck Pizza, which was smaller than normal size, so they could sell it cheaper and, as a byproduct, it could fit in toaster ovens (convenience will be a central theme to this piece)

Frozen capacity was fixed and costly, so you need to have super productive items

Aldi was not doing much frozen food before getting involved with Trader Joe’s

Clearly, Trader Joe’s was ahead of the curve with regard to carrying Frozen products, and that was a repeatable differentiation for them to gain customers. As depicted in this article on frozen food, at the time when Trader Joe’s was first rapidly expanding, frozen food quality was not great elsewhere, especially on the meal side. So we can thank Trader Joe’s partially for the rise, but what else is a factor more recently? The air fryer has made frozen cooking more convenient (ownership is up 22% YoY), improved the efficiency/space of freezers has helped too (half of American households have a secondary freezer), and brands are actually focusing on building quality products.

From a numerical perspective, here are some highlights from ConAgra Brands, one of the leading frozen food companies (owns Birds Eye), frozen foods report:

The United States is the largest Frozen Foods market

The total frozen market is $91B, roughly a third being frozen meals and another third being frozen meat and seafood

Airfryer sales are up to $6B annually in the United States

In-home eating has increased by an additional $25.6B since 2019

Some pretty powerful numbers. I am pretty excited about the future of frozen, and its role in propelling retail to a new era. Here are five takeaways/trends I am excited about that will factor into the growth of frozen foods and retail in lockstep (plus keep scrolling for a new section on Industry POV):

1) Customers Want Freshness/Nutrition But Don’t Want To Pay For It

Coefficient Capital and The New Consumer put out a great research report on consumer sentiment and trends. This edition mostly featured topics around AI, but what stood out to me was the section on the future of healthcare. Americans want to live longer, but they do not want to pay much more to live longer. That is where frozen food comes in. You can get healthier, cheaper, high-quality food. I divide frozen foods into three categories: need to be frozen (ex. Ice Cream), ingredients (frozen fruits, meats, seafood, vegetables, etc.), and finished meals (ex. Frozen Fried Rice). For this topic, let’s focus on ingredients and finished meals. For both of these subcategories, you can really get good items for a lower quality. In fact, frozen ingredients are often flash frozen right at the time of harvest, which retains more nutrients compared to traveling across the world/country. As the 6% of the population using GLP-1s continues to grow and more consumers increase their consciousness around health, frozen foods often an excellent solution.

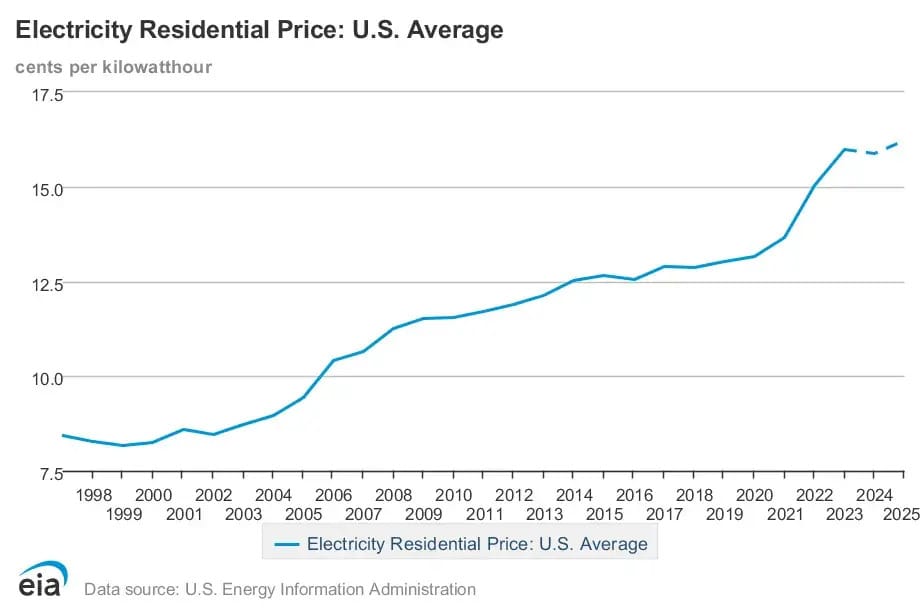

2) Electricity Cost Increases and More Freezer Space

Despite advances in technology, the electricity price growth has outpaced inflation. Still, that has not stopped consumers from expanding their bills by adding a second freezer (nearly half of households have one). One takeaway here is that customers feel that the additional value and quality of frozen food in #1 are worth the extra cost. Plus, with all the technological advances we are seeing with AI, computing, etc. there will be an inflection point where the electricity cost starts to fall. For the retail perspective, I don’t think they will be ripping out shelves to add in freezers; I just think they will be turning over product faster, requiring more frequent replenishments.

3) Consumers Want Easy, Convenient Products

Consumers are looking for more convenient cooking options. That is one reason why air fryers have seen such popularity growth. You are able to have such high-quality meals, and all you need to do is dump some stuff in the air fryer basket or on a sheet pan. The ability to eat high-quality products that still fit into people’s busy lives is a win-win for all. Plus, as people want to cut back on restaurant spending, they can still have some of their favorites available in the frozen aisle.

4) Lower Production Costs

In terms of price, generally, if you have two items of equal quality, frozen and fresh, the frozen one will be cheaper. Why? As you trace your way up the supply chain, the core theme becomes less waste. Once it is picked, an ingredient is frozen and remains so until you put it in your shopping cart. In addition to less waste driving down costs, the processing part is easier, and frozen items are typically less fragile. Since the waste issue is lower, transportation savings are plenty because you aren’t in a rush to get the product to the customer before it expires. Finally, on the meal side, you can bulk produce in a way an individual restaurant or supermarket is unable to, which leads to true economies of scale that drive down costs as well. Ultimately, despite the higher refrigeration and electricity costs throughout the supply chain, that is outweighed by the cost of spoilage.

5) Beyond Supermarkets/Consumers: Wonder

Most of this piece thus far has focused on a segment of retail, supermarkets, and the shoppers who purchase goods there. That area, I believe, will see the most growth due to frozen food, but I do believe other areas, like restaurants, are already poised to further capitalize on frozen foods. One report shared that 90% of restaurants are using some type of frozen products. Most of this is at the ingredient level, but I do believe that as customers are seeking value, and also eat outside the home, more places will pop up for flash frozen meals, especially for lunch. Restaurants like Wonder, which I have covered extensively, are already producing their goods at a central commissary, cooking them most of the way, freezing them, and then heating them up at the last minute. I think you will start to see this segment grow further.

Industry POV: Is Frozen Food The Future of Retail?

Following the temporary acceleration of in-home cooking during COVID-19, American consumers are back to in-person/hybrid working mode (and many are still in parenting mode!). More than ever consumers are seeking clean, nutrient dense meals that take minimal preparation efforts. Frozen is a perfect solution. There's also an inherent time pressure that comes with purchasing a perishable item. All of a sudden you are on the clock to finish the product before the expiration date. Frozen mitigates this tension, empowering consumers to waste less and maximize the bang for their buck. Emerging brands in the category have the opportunity to leverage frozen to solve for both convenient indulgence and convenient nutrient density. A few emerging frozen brands I've grown to admire: Incredifulls, Fruit Riot, Laoban, Evergreen, and Smearcase. Entrepreneurs should be extra vigilant of entering this category without robust margin planning. Cold shipping can be very tricky and costly. Further, getting your brand to stand out behind a foggy sliding door is no easy feat.

Is Frozen Food The Future of Retail?

Kraft Heinz x Lollapalooza x Live Nation

Kraft Heinz Partners With Live Nation To Bring In Products

I am super bullish on experiences as the future of retail. While it may not be a traditional definition of retail, I strongly believe concerts are an extension of retail, and a great opportunity to drive trial and awareness. It seems that Kraft Heinz agrees as well, because they just announced a big partnership with Live Nation, which operates 80 venues across the country. The new partnership will see Kraft Heinz’s Condiments and Mac and Cheese featured across the locations. One other interesting part of the deal is that there will be a big kickoff to the partnership at Lollapalooza to get started. Given Kraft’s track record, I expect this to catch a lot of headlines. On the Live Nation front, it will be interesting to see how they continue to add partnerships with CPG brands.

Starbucks Closing Pickup-Only Locations

This week, Starbucks had its earnings call. On the call, much was shared, including the emphasis on the plan to get back to its roots of what made it successful. One of those things that is not part of the Starbucks experience, because they view it as not an experience, despite it being all part of Starbucks, is the pickup-only stores. Originally piloted in NYC in 2019, these stores were only for mobile orders and were fulfilled out of small-format stores with pickup windows. Clearly, something was working, as it was rapidly expanded to over 90 locations. Now, all that comes to an end as the pickup-only stores will be closing. This move is also on the heels of Luckin Coffee opening in the United States, with its pickup forward model. It will be interesting to see how Starbucks proceeds from here. CEO Brian Niccols emphasized that pickup mobile orders will be a big part of the business going forward, maybe this just helps save on capex.

PopUp Bagels Expansion Efforts

I have written about PopUp Bagels several times, with the most recent deep dive being in Issue #45, in April. Like most startup news, that piece 4 months later is already out of date, as PopUp announced this week another expansion push with their new franchising model. The updated plan, based on current agreements, is to scale the number of locations to 300 across 15 different franchise partners, with a focus on Atlanta, Nashville, and Orlando. These areas were selected due to the PopUp Bagel team feeling like bagels were underpenetrated in those markets compared to others. On top of this expansion push, they just raised a Series B as well, led by Stripes, the growth equity fund.

Summary: Continuing on the frozen and convenience theme, I decided to feature Bakr, a frozen ready-to-bake cookie dough brand. Currently, on the market, there are not many frozen cookie dough brands, instead, most are in the fresh department and have to deal with more perishability issues.

My Take: I love the convenience of the product, but also I love how high quality the ingredients are. These use butter, whereas most other brands rely on some type of oil. The frozen aspect helps them be able to use butter. As somone who loves cookie, not only is butter healthier than processed oils, but it also tastes WAY better.

Founder(s): Alexa Ryan

Funding: Unknown

Number of Locations: Sold in 321 stores

Social Media Following: 16k on Insta

Additional Links:

Walmart adds a new product line to compete with Target for the 8-12 year old customer demographic (read more here)

Sugar Capital raises third fund, part of the rebound of early-stage consumer investing that previously fell off in the past couple of years (read more here)

A deep dive into the expenses of growing restaurants, and why you need to front-load your corporate G&A (read more here)

The original founder of Outdoor Voices is back in charge, and under her leadership, previously Outdoor Voices was once one of the trendiest, fast-growing retail brands (read more here)

VMG Partners, the growth equity fund, raised a new consumer fund (read more here)

What is the latest news from P&G’s fiscal year close? (read more here)

Best Buy & Ikea are piloting Best Buy stores within Ikea (read more here)

Amazon made more money from ads, subscription fees, and seller fees than it did on the goods it sold (read more here)

120 J.C. Penny Stores sold to PE firm Onyx Partners (read more here)

Kroger sees some shuffling in executive leadership as it tries to restructure (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.