Issue #65: Once Upon An IPO

After such an overwhelmingly positive response (thank you!) to Issue #64 on NYC’s retail AI boom, I decided to create a living market map where I would make updates and adjustments. The article is linked here. Already, I have one to add!

Bops ($3M Raised) - Bops utilizes AI to help ensure brands are not out of stock on retail shelves. The software helps maximize in-stock rates, profitability, and reducing lost sales.

Stay tuned for further updates, and please keep sharing retail AI startups as you come across them!

What retail channels do Once Upon A Farm Sales come from?

Once Upon An IPO?

You may know Jennifer Garner for her countless appearances in film and television, starting in movies like Alias, Juno, Dallas Buyers Club, Alexander and the Terrible, Horrible, No Good, Very Bad Day, and more! You may also know her from the Capital One commercials. But did you also know she started a baby food company, that just filed for an IPO?

Once Upon A Farm was founded in 2015 by Cassandra Curtis and Ari Raz (who went on to found The Coconut Cult) to create a better baby food product than current options. Shortly after entering retail, in 2017, Garber joined the team, as well as John Foraker, the former CEO of Annie’s, which is also known for its crackers, mac and cheese, and many other healthier products. Fast forward to now, Once Upon A Farm is in over 13,000 stores and has over $200M in trailing 12 month sales, with an assortment of pouches, bars, meals, and more for babies, as well as kids.

Based on this success, albeit a bit earlier than most companies would at only $200M in sales, Once Upon A Farm decided to go public, which gives us a great opportunity to break down their S1. There are a lot of great financial-oriented breakdowns (Drew Fallon’s is always a favorite of mine), but I want to focus on the retail aspect. Let’s dive in!

Right off the bat, the S1 focuses on its retail success, which makes sense, at the public markets level retail is what matters for CPG brands not eCommerce. It has helped that they have a great brand and value prop, which leads to these sales being incremental for the retailer. A win-win for both sides. Specifically, here is what stands out to me from a retail POV:

In retailers Once Upon A Farm sells in, they are driving the most dollar sales growth in their categories

Over 430k points of distribution (number of stores x number of products/SKUs they have in those stores) at stores like Target, Whole Foods, Kroger, Walmart, Publix, and Wegmans

Their branded refrigerated coolers (2800 deployed) help drive sales and incrementality - 60% of sales from coolers are not cannibalized - for 3-5k initial spend, they get $10.5k in annual sales (not the best return, but the halo effect from the additional visibility is there)

Their core demographic (wealthy parents) spends $78B annually in retail - an opportunity for product expansion - as well as spending 1.5x annually and 2-4x more per trip

They stock products in both the refrigerated produce section and center store dry grocery aisles, a strategic choice to have an “all aisle” presence

35% of their retail sales come from online channels (Instacart, DoorDash, etc.)

The marketing strategy is a mix of in-store channels (retail media, in-store activations) and digital channels (social media, influencers)

The average retailer carries more than 20 of their SKUs, with top retailers carrying 30-60 SKUs

Some fascinating insights on the retail strategy. However, questions are to be asked as to why they are going public. Despite strong sales growth, the total revenue is pretty low for a public company, and Once Upon A Farm is not profitable. It seems like it is some combination of investors wanting liquidity, the timing being right, and needing to get capital to further fuel marketing (one of the fastest-growing expenses). It is certainly a strong company, but it feels a little early to go public. What do you think?

DoorDash’s new robot, Dot, more details here

DoorDash’s Busy Week - New Partnerships, Acquisitions, & New Tech

DoorDash has been in the headlines frequently recently, as it continues its quest to own all of local commerce, from restaurants to groceries to hardware purchases. This week was no different, with a couple of big moves happening - let’s break them down:

As of October 1st, Kroger is now on DoorDash, which adds grocery delivery from nearly 2,700 supermarkets under its various banners. Instacart has traditionally dominated the grocery delivery space, but DoorDash is quickly encroaching on that dominance with its 42M monthly active users globally

DoorDash recently announced the acquisition of Deliveroo, a UK/European-based food delivery service. Given the scrutiny of acquisitions that occur there, there was some questioning as to whether that deal would be approved. As of October 2nd, that deal was officially approved, meaning now DoorDash is active in over 30 countries.

Finally, DoorDash’s core business remains food delivery. With the rise in autonomous vehicles, it only made sense that they would launch an autonomous vehicle. This week, DoorDash announced Dot, a robot one-tenth the size of a car, which can travel on bike lanes, roads, and sidewalks, reaching speeds of up to 20 mph. Logistically, I am a little skeptical that this robot will be able to scale, as similar concepts have existed for a while with limited success. However, out of all three announcements, I am most interested in following this one. Here is a video of the robot in action:

Wakefern Finalizes Purchase of Morton Williams

You probably haven’t heard of Wakefern Food Corp., but I would gander that most subscribers have shopped at least one of their locations. Wakefern Food Corp is a cooperative between a number of small/mid-size grocery store chains to help reduce product costs by consolidating purchasing. There are 45 member companies who own and operate 365 retail supermarkets under the ShopRite, Price Rite Marketplace, The Fresh Grocer, Dearborn Market, Gourmet Garage, Fairway Market, Di Bruno Bros, and other banners. Wakefern also owns some of the locations. Most recently, Wakefern announced that its purchase of Morton Williams was finalized, giving them 17 locations within the NYC area. For Morton Williams, it makes sense given the high prices it is currently known for. The cooperative’s lower cost will help attract more shoppers with lower prices. For Wakefern, it allows the growth of the portfolio overall, as well as adding density to an area where they have a strong footprint already, meaning the distribution costs will remain low.

Instacart Giving CPGs Real-Time Shelf Visibility

Ask any CPG brand, and they will say one of the most challenging parts of operating is understanding your product’s retail shelf at scale. Are they in stock? Are they priced correctly? Do the displays look good? Without someone physically being in the store to check what is happening, it is really challenging to get a POV. Now imagine one store multiplied by 13,000, like in Once Upon A Farm’s situation. It would be really costly and unscalable to send people everywhere. That is where Instacart comes in. They already have shoppers in these stores, who have a camera to validate what is happening. So, Instacart partnered with Advantage Solutions to offer a service to CPG brands. Here is the flow:

The brands request the data/image from Instacart

An Instacart shopper gathers the information

The information gets sent to Advantage and the brand

The brand decides to act based on the information from the shopper

Advantage executes the action

An Instacart shopper verifies that the action is complete

Overall, a pretty seamless process solving a big problem. Given that a lot of this process is already happening in a fragmented way, it should help solve problems without a huge cost. It will be interesting to see how many brands leverage this feature, but if I were a brand, this feature is definitely something I would test. You can’t sell your product if it is not merchandised properly.

Note on my local Starbucks announcing the closing

Starbucks Locations Start Closing

A couple of weeks ago, Brian Niccol, the new Starbucks CEO, announced that he had made some tough decisions to further cut personnel and start closing more locations. This week, the closed stores started announcing closure, seemingly overnight. I have one Starbucks by me, and one day it was in operation, the next, a note was taped to the door, and brown paper was covering the windows (note above). While the exact number of locations closed is unclear, it appears to be hundreds of stores. Based on the note shared a couple of weeks ago, closed stores were chosen due to the poor physical environment or a weaker financial performance. With regard to this location, I do not feel that either of those criteria fit - it always seemed to have steady foot traffic as well as a strong setup. There are several other locations nearby, as well as a Barnes and Noble across the street. Maybe the area has some oversaturation, and they figured the sales traffic would get absorbed by other locations. Although these are tough moves, they are actions that definitely need to happen. It still remains to be seen if the changes are not being done too late. Starbucks is facing competition from all sides, but luckily has a big head start on everyone else.

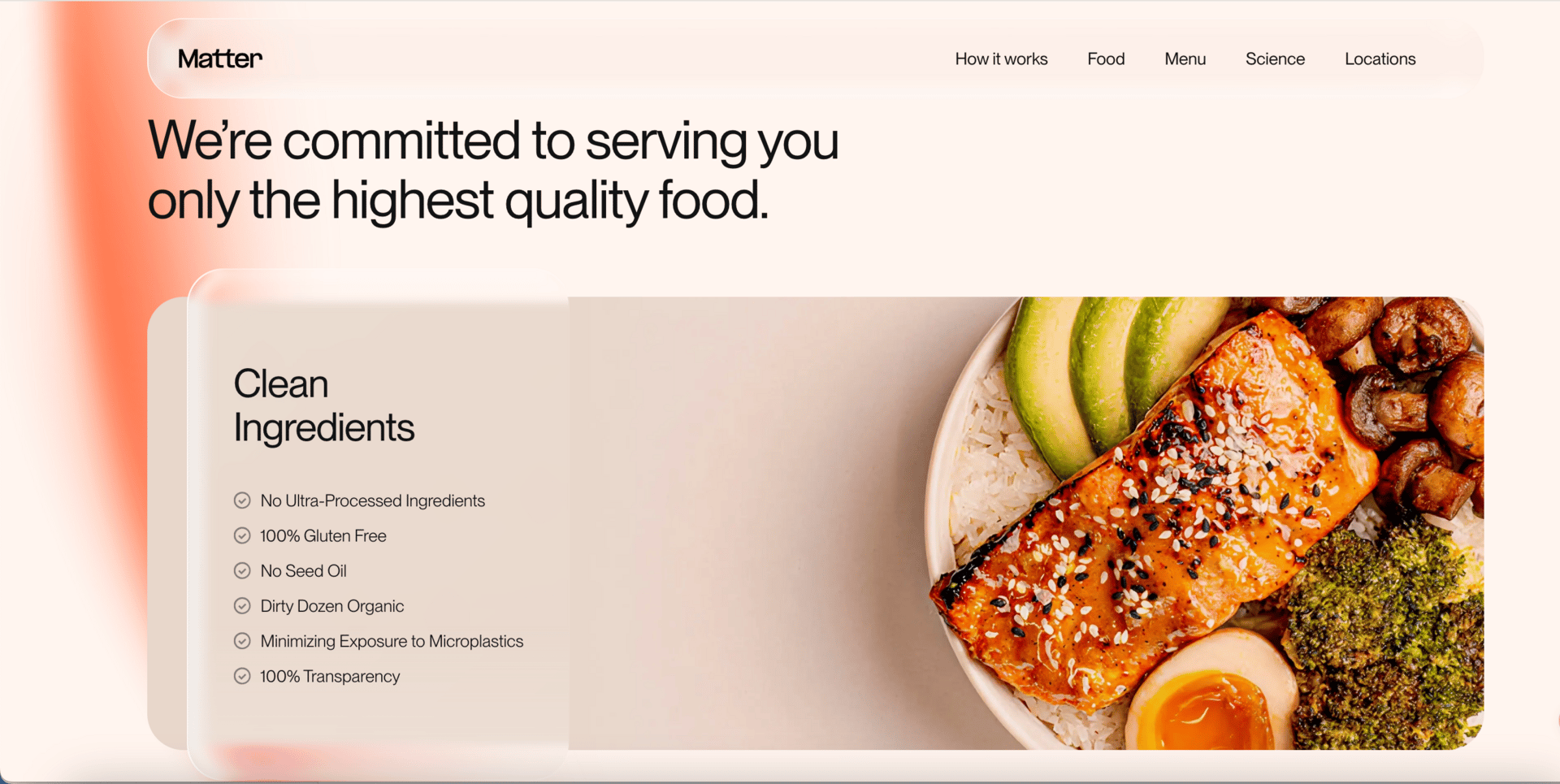

Matter’s digital nutrition and restaurant hybrid

Summary: Matter Formula is a precision nutrition platform and restaurant opening soon in NYC. It pairs a digital nutrition planning and tracking tool with an actual restaurant. The digital nutrition sets a personalized calorie and macronutrient goals, and then customizes the meal to match those needs.

My Take: Currently in the market, there are plenty of digital nutrition services and plenty of loosely customized meal kit services focusing on nutrition. However, without the full stack connecting both, it is very challenging to solve the problems together seamlessly. I think it makes sense to connect the two, and I am excited to follow along!

Founder(s): Jon Sherman

Funding: Unknown

Number of Locations: One opening soon in NoHo (Manhattan)

Social Media Following: just launched social

Additional Links:

Slutty Vegan founder, Pinky Cole, launches franchising after buying the business back post-restructuring (read more here)

How a founder of a non-alc beer in the UK is leveraging retail and on-premise to grow the brand (read more here)

PE firm Thomas Bravo purchases restaurant software company Olo, taking it private (read more here)

ChatGPT now has a checkout in the platform powered by Stripe (read more here)

Algae Cooking Club, an algae oil, is now available in Target (read more here)

Stripe announces OpenAI partnership and other AI commerce updates (read more here)

Mindbody, the owner of ClassPass, and Disco, the post-cart advertising upsell platform, announce a partnership (read more here)

How is DoorDash improving its unit economics (read more here)

Why are CPG brands a better investment than software? (read more here)

Olive Garden launches smaller portions as customers seek value and health (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.