- Retail Is Not Dead?

- Posts

- Issue #79: Aldi Spotlight

Issue #79: Aldi Spotlight

Let's deep dive into one of the biggest supermarket retailers in the world!

Issue #79: Aldi Spotlight

This week, I had the pleasure of reading Kendall Dickieson’s 26 Things That Will Help Your Social. It had a lot of great content in it, and I recommend a read, but in particular, this one stood out to me:

If growth feels stuck, it’s usually a distribution problem that can be born out of a content or product issue. You (most likely) need more top-of-funnel, more entry points, and more ways for people to “accidentally” discover you. Saying the same thing in more places beats saying new things to the same people. Influencers posting nonstop, content living beyond one platform (or account), through partnerships with other brands, and showing up where new audiences already are that’s how momentum actually builds. Talking to the same people won’t get you far.

In 2026, one of my goals is to rapidly grow this community. Most growth has come via my existing network as well as posts on LinkedIn. As Kendall mentioned, I am looking for new top-of-funnel areas for people to discover this newsletter. What areas would you recommend that I explore in 2026 to explore?

What Is This Aldi Store Near Me?

Aldi is one of the largest grocery chains in the United States. It recently opened SIXTEEN stores in one day. It also received fifth place on Dunnhumby’s latest Retailer Preference Index, only behind Costco in terms of national chains. Finally, as if that wasn’t enough, it is opening a 25,000 square foot store in New York City, in Times Square. This will be one of the largest stores in the Aldi ecosystem. Aldi has built an impressive operation, but admittedly, outside of a few trips in college, and visits while in Europe, it is a store I have not spent too much time in / understanding. I figured I may not be the only one in a similar situation.

Let’s start with the history:

1913 - Anna Albrecht founded a small store in a suburb of Essen, Germany

1946 - Aldi (short for Albrecht-Diskont) is founded by two brothers, Karl and Theo Albrecht, when they take over their mother’s store

1950 - Albrecht brothers have amassed a small chain of 13 stores, focused on providing the lowest price by not carrying produce, removing low-performing items, not spending money on advertising, and keeping the store footprint small

1960 - Now at 300 stores, brothers split Aldi after a dispute, the source of which exactly is unknown, but has been rumored to be about whether to sell cigarettes or different management styles

1966 - Aldi is now split into Aldi Nord (you are familiar with this company, but not in the way you think - to be revealed later) and Aldi Sud (the Aldi you are familiar with in the United States)

1967 - 1973 - Both stores focus on international expansions, with Aldi Sud launching in Austria and Aldi Nord launching in the Netherlands

1976 - 1979 - Both stores now focus on the United States for expansion, with Aldi Sud opening a store in Iowa and Aldi Nord acquiring Trader Joe’s (told you that you are familiar with Aldi Nord!)

1993 - Both brothers step down and place the control of the companies in private family foundations

2001 - Aldi opens its first store in Sydney, Australia

2010 - Aldi Sud pulls out of Greece after spending $1B in two years

2018 - First Aldi store in Italy opens

2023 - Aldi Süd acquired Winn-Dixie and Harveys Supermarket in the US, with plans to convert some into Aldi locations and sell back to C&S Wholesale Grocers

Now this news came out in June, and it has been crickets since. In the original reporting, the goal of the families was to have this completed by the end of 2025. Even though that didn’t happen, I am very confident that it will eventually happen. The companies already collaborate on private label products, marketing, and more. In my opinion, it is a matter of if, not when, the two companies merge, which could slightly impact Trader Joe’s. This merger would bring together 13,400 locations across 18 countries.

Ahead of any potential merger, let’s dive into what makes Aldi special:

Consistency

Low Pricing

Private Label products you can’t find elsewhere

Good value: quality and price intersection

Limited assortment

Weekly special aisle with items you can only find that week for a great price

The store layout is very simple and easy to navigate

Speedy checkout

Customizes assortment to match local/regional preferences

Low Pricing x2

If you're reading this, and it sounds very similar to Trader Joe’s, that makes sense. The major difference, I would say, is that while both are focused on low pricing, Trader Joe’s wants it to be more of a fun experience, whereas Aldi is more about an efficient experience. Despite the differences, these are both concepts I see succeeding in the future, albeit with different types of customers. What stands out to you about Aldi?

Rendering of Amazon’s proposed superstore

Amazon Announces Super Store Opening

This week, Amazon announced that it would be launching a new concept in the Chicago suburbs, a superstore. Similar to a Walmart or Target, this store would be a large-format store filled with groceries and general merchandise. Over the years, Amazon has tried various forms of retail with Whole Foods, Amazon Fresh, Amazon Books, Amazon Go, and more. None of these has been too successful, but the outlandish popularity of Amazon Web Services and Amazon Prime has allowed them to keep experimenting. Based on the continued attempts at retail, one could say that Amazon is bullish on retail. What could make this attempt successful, while the others have not been so much, is that it will also have eCommerce fulfillment in it - sort of an omnichannel hybrid between distribution center, fulfillment center, and regular retail. It makes sense that this type of store is the future of large-format stores; otherwise, it will be hard to justify the rent expense in expensive areas. One area to monitor here as well is Target, they are already lagging Walmart and struggling overall, I wonder if Amazon tries to purchase Target?

National Retail Federation (NRF) NYC 2026

NRF is the biggest retail trade association in the world. In addition to advocacy, monitoring data trends, and consumer insights, it also hosts a massive conference around this time at the Javits Center in NYC. Since tickets for that conference can be expensive and hard to get, for those in the NYC area and interested in retail, there are a lot of great free events to check out. Here are some of my favorites!

January 11th from 4:00 PM - 6:00 PM: SmarterSips: NRF Welcome Hour Presented By Klaviyo

January 12th from 8:30 - 10:00 AM: Consumer Brews – NRF Edition

January 12th from 6:00 - 9:00 PM: NRF Happy Hour with Lunar Solar Group

January 14 from 6:00 PM - 8:00 PM: UGLY TALK: 2025 LEARNINGS & 2026 PRIORITIES IN D2C & CPG

Hope to see some of you there! And stay tuned for next week, when I will share some takeaways from my conversations there!

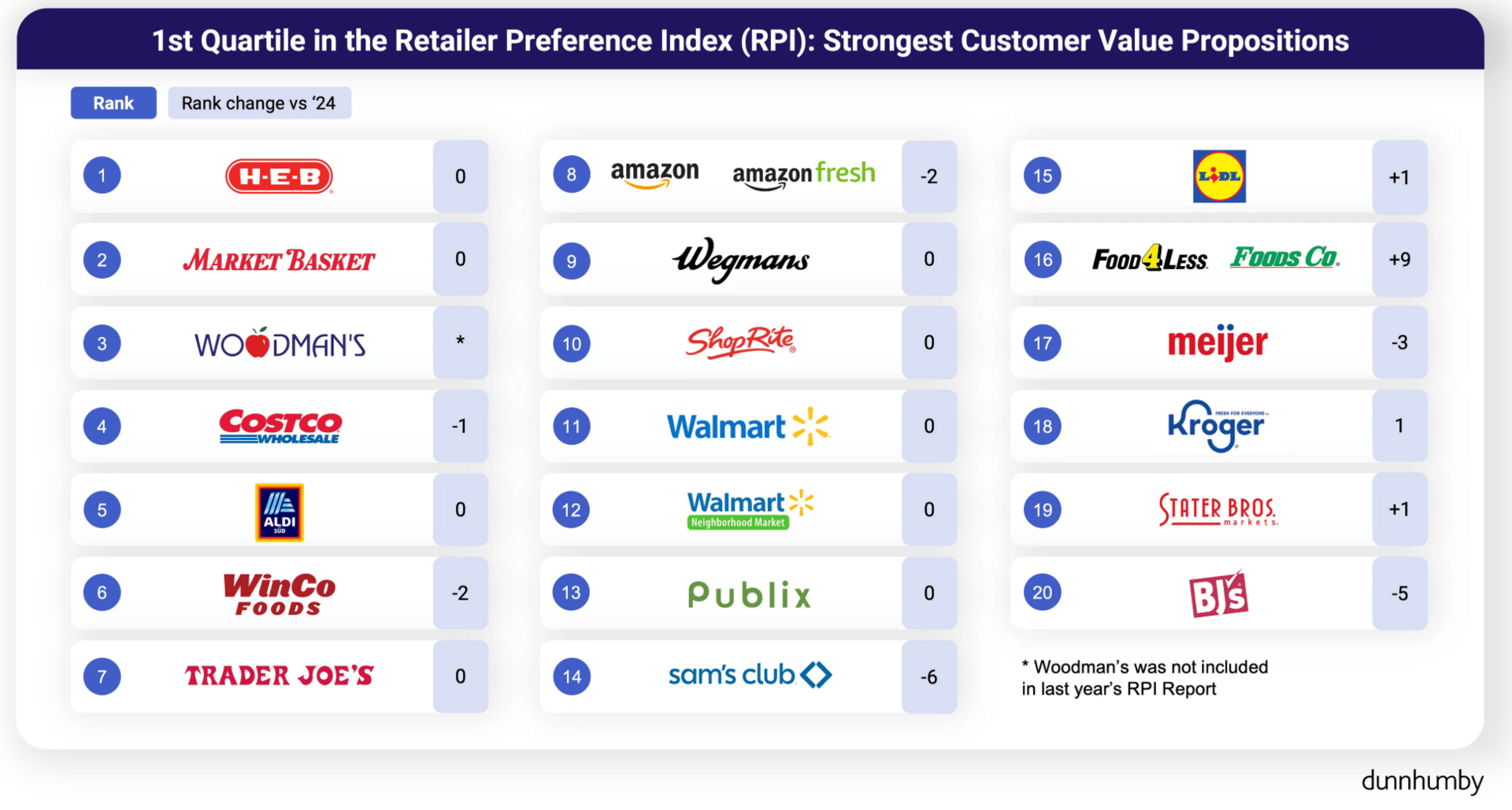

Here is how the retailers shook out in this years rankings

dunnhumby’s Announces 2025 Retail Index & Insights

For nine straight years, dunnhumby, a company that helps retailers and brands manage loyalty, media, and category management, has conducted an analysis on the Retailer Preference Index (RPI), measuring customers’ perception of grocers/retailers and the company’s financial results.

It has a lot of fascinating takeaways in it, but I wanted to share some of my favorites here:

Regional chains (Woodman’s, Wegman’s, HEB, etc.) really dominated the rankings, taking six out of the top ten spots

41% of a retailer's long-term success is based on "saving customers money" through competitive pricing, promotions, and rewards

Shopper confidence dropped as concerns about higher prices, fewer job opportunities, and stagnant wages eroded purchasing power

Consumers across all income levels are feeling the squeeze and making more value/price-conscious decisions

United States consumers prioritize "saving money" on groceries more than their peers in other developed countries

Quality differentiates the various value-driven retailers

The consumer base is becoming smarter and smarter

Retailers need to choose a lane and stick to it; undifferentiated retailers struggle the most

What are your favorite takeaways?

Snapshot of the products from Croft Alley

Summary: Croft Alley is an LA-based all-day cafe that just opened in NYC. Its menu features a mix of breakfast, wraps, salads, bowls, sandwiches, and beverages.

My Take: All-day breakfast continues to rise in popularity with more and more retailers offering these options. I am super bullish on that concept, and Croft Alley is one of the companies I have my eye on.

Founder(s): Michael Della Femina

Funding: Unknown

Number of Locations: 3 (2 in LA and 1 in NYC)

Social Media Following: 15.4k on Instagram

Additional Links:

Instacart highlighted its 75 fastest-growing CPG brands (read more here)

Walmart and Google announced a partnership to integrate Walmart purchasing into Google (read more here)

How loneliness is impacting restaurants and food (read more here)

New commercial real estate hit its lowest amount in 2025 since 2013 (read more here)

Pepsi’s North America CEO wrote a piece breaking down how retail’s seasons have shifted (read more here)

Frozen food is on the rise, here is why (read more here)

Sweetgreen announces new menu in partnership with Function/Dr. Mark Hyman (read more here)

How Wonder is planning on integrating automation into its operations (read more here)

Interesting analogy into how the invention of AI is similar to the invention of plastic (read more here)

How in 2026, more people will be doing zero-click buying (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.