Issue #40: Walgreens Going Private

Before we hop into this week’s issue, the 40th issue of Retail Is Not Dead?, I wanted to take a moment and say thank you to everyone for subscribing. When I started Retail Is Not Dead? almost a year ago, I wasn’t sure how long it was going to last. It suffices to say I am super grateful for all the support and really have enjoyed it so far. There is much more ahead, but looking back, if I wanted to highlight one issue as my favorite, it would probably be the market map on the bowls/salads/wraps places in Issue #33 (check it out if you have not already!). As we keep progressing to the next milestone, 50 issues, my goal is to grow this community to 150 subscribers. If you know anyone who might be interested in a recap of the trends in retail each week, I would greatly appreciate you sharing Retail Is Not Dead? with them. And with that, on to the biggest retail news of the year so far.

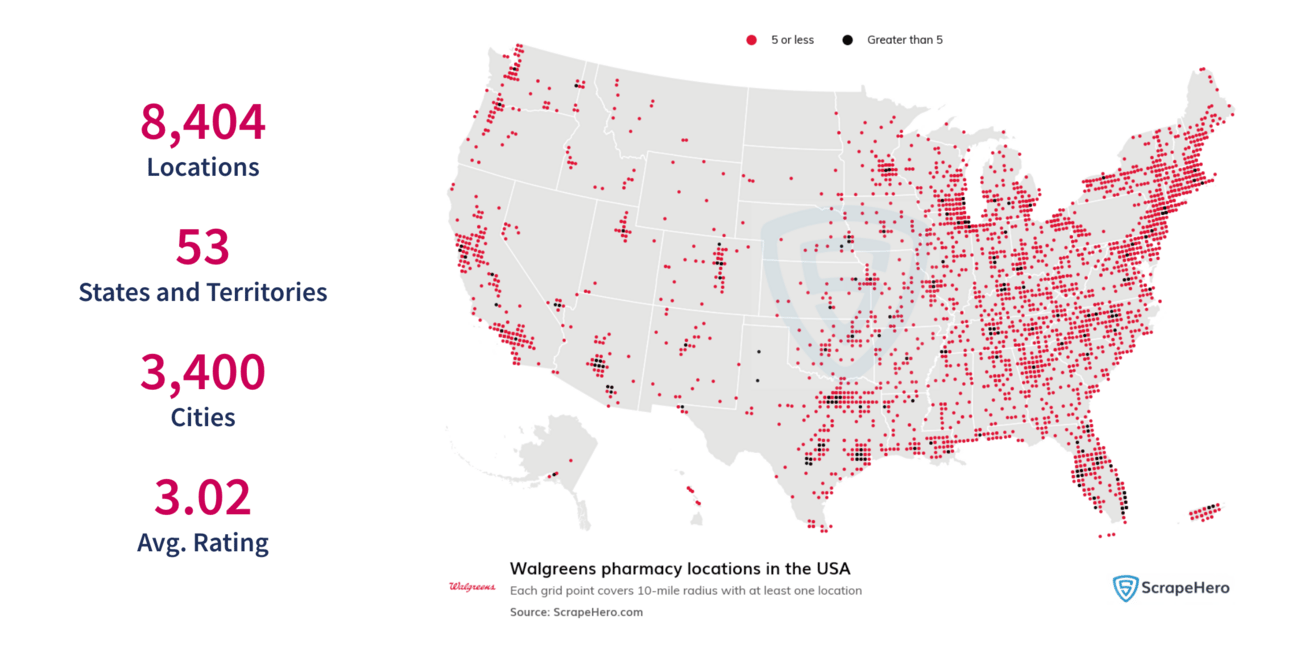

A cool viz of Walgreens locations across the country from Scrape Hero

As a proud UConn Husky, let’s just say I am very accustomed to crazy events happening in March. Shoutout to Cardiac Kemba and all the other Husky legends who have made March so memorable in my life! However, in the retail world, March is not typically a crazy month, just another month in the year. In the retail world, the March Madness occurs in October/November/December in the later parts of the year. This March, however, might be the month that defines retail for the year. It could be positive, it could be negative, but it will be defining.

For those who haven’t seen the headline yet, Walgreens Boots Alliance reached an agreement with Sycamore Partners to be taken private for $10B, with escalations depending on performance to take it to $23B. A far cry from 2015 when Walgreens was valued at $100B. Before we jump into the deal, let’s focus on the players:

Sycamore Partners - Sycamore Partners is a PE firm focusing on retail located in NYC with roughly $10B AUM. Some notable investments include Playa Bowls, Chateau Ste. Michelle Winery, Loft, Ann Taylor, Staples, Talbots, Hot Topic, and more!

Walgreens Boots Alliance - Walgreens Boots Alliance is a retailer and pharmacy with 12,500 locations across the United States., Europe, and Latin America under its banners. Its banners include Walgreens, Boots, Duane Reade, No7 Beauty Company, and Benavides. Walgreens currently employs 311,000 people across 8 countries.

The first part to highlight from the deal, this is not Sycamore Partners first rodeo-taking a distressed retailer and trying to turn it around. However, there is a lot going on with Walgreens that will ultimately impact the deal. First, it seems that the Primary Care businesses, Village Medical, Summit Health, and CityMD, will be sold off. That does not mean that healthcare will not be the focus. The MD at Sycamore Partners explicitly mentioned and led with Walgreen’s “pharmacy-led” model, which is a window into where the focus is. It will be interesting to see what specific plans come out on the pharmacy side, as that has been an area that has not succeeded in the way Walgreens has hoped. Compare that to CVS, which has seen more limited success with focusing on the PBM and insurance side of pharmacy, maybe that is the path they will pursue.

In my opinion, Walgreens needs to really boost the retail experience. When you go into the stores now, most of it is locked up behind glass, there are not many employees to help you, and the product assortment is not exciting. Many of the stores are also very large for what they have. If it could decrease square footage, which it can’t, it could still do similar revenue. Regardless, given the scale of Walgreens, there is a lot that could go well and a lot that could go wrong - the excitement of retail! Mark your calendars for April 8th, the next earnings call for Walgreens. Let’s see how they do before entering the private domain.

In five years, how many locations will Walgreens have in the US?

The rapid growth of Mixue

World’s Largest Fast Food Restaurant IPOs

This week, the world’s largest fast-food restaurant IPO’d. No it was not McDonald’s, KFC, Starbucks, or Taco Bell. The restaurant is called Mixue Ice Cream & Tea, and specializes in ice cream and tea drinks at very low prices. Started by a student in 1997 as a street stall in Zhengzhou, it has blossomed from that. After refining the concept across a couple of locations from 1997 to 2007, in 2007 it really started to take off with the launch of franchising. In 2018 it launched its first store outside China and in 2020 it launched its 10,000th store. Fast forward to the present day, there are over 45,000 locations, across 14 countries, you now have the world’s largest fast food chain. The big headline this week was an IPO on the Hong Kong stock exchange raising $444m and valuing the company at $10B. The company has a great logo and mascot, which helps it go viral on social media. The exciting part for investors is that all this growth has been without entering the United States or Europe. In these areas, bubble tea has skyrocketed in popularity, which plays right into Mixue’s strategy. The pricing may not be able to hold, however, the quality product and branding will help propel them. I am excited for its eventual United States launch, whenever it is!

Square Raising Credit Card Fees

Square, the credit card payments processor, announced that it will be raising the rate it charges for in person payments. When you are paying with a credit card anywhere, the credit card processor charges the merchant you are buying from a fee, split between a percentage of the total sale and a flat fee per transaction. That is one reason why retailers love larger transactions because the cost is spread out. That fee goes to the payment processor to cover its costs. One of the largest payment processors, Square, announced that it will be raising the flat fee it charges from, $0.10 to $0.15, to accompany its 2.6% charge. On its surface, not a huge increase, but one that can have a huge impact. Let’s break down the two scenarios at your favorite pastry shop where you are buying a chocolate croissant for $6.

2.6% + $0.10 - $6 × 2.6% = $0.16 + $0.10 = $0.26 or 4.3% of the transaction

2.6% + $0.15 - $6 × 2.6% = $0.16 + $0.15 = $0.31 or 5.2% of the transaction

As illustrated in the example above, you can see that even though the transaction cost jumps $0.05, it jumps almost a full percentage point, aka a 21% increase. For retailers that have low average transaction values, like coffee shops, bodegas, and bakeries. This can really make or break their profitability on an already tight margin. In response, retailers will have to raise prices or absorb the costs. Another challenge for retailers to overcome.

Sur La Table Doubles Down On Coffee

This week, Sur La Table, the cooking equipment and cooking class retailer based in Seattle, announced that it was acquiring another Seattle-based business, Seattle Coffee Gear. Seattle Coffee Gear is a specialty retailer focused on coffee equipment and suppliers. Some items for sale include espresso machines, coffee beans, and commercial equipment. It currently has 3 locations, 2 in Seattle and 1 in CA, where it offers equipment for sale plus classes on how to make various coffee items. Plus, Seattle Coffee Gear has a robust eCommerce business. As specialty coffee continues to rise in popularity, it makes sense that Sur La Table wanted to double down into the space. With the similar business models of retail and events, the synergies further stack up positively. I am assuming that the Seattle Coffee Gear brand will be folded into the broader business rather than opening up additional separate retail locations. Whatever the plan is, it is a very exciting move, and will be great to follow along.

Tigawok’s mini bowls featured prominently on its website

Summary: Tigawok is a fast-casual restaurant serving Chinese fusion cuisine in a bowl concept. Unlike many other fast-casual concepts, the majority of the cooking is done via automation. It was founded by two veteran restauranteurs in Los Angeles using machines sourced from China via an American restaurant equipment distributor. At most, 5 or 6 people are needed to run the restaurant during peak time, less than most other fast casual competitors.

My Take: As previously mentioned with the credit card processor Square raising rates, restaurants and other food establishments are seeing costs skyrocket. Aside for raising prices, other levers need to be utilized to control costs. These machines can help supplement existing labor and ensure that restaurants are able to keep up with busy periods to make additional revenue. Given that these machines are commonly available, it would not be a surprise to see it roll out across other fast casual establishments.

Founder(s): Tomas Su, Kelvin Wang

Funding: Unknown

Number of Locations: 2 (Los Angeles and Burbank)

Social Media Following: 18k on Instagram

Additional Links:

Who will be the first $1 Trillion valued restaurant (read more here)

Wingstop working to create buzz by auctioning off the first bottle of ranch they do as a CPG, maybe in store sales coming next? (read more here)

Gap reports earnings, led by a strong quarter from Gap and Old Navy (read more here)

On the Border Mexican Grill and Catina files for bankruptcy (read more here)

Taco Bell targets and average unit value of $3M by focusing on its chicken menu (read more here)

Wayfair is planning to lay off 340 employees (read more here)

How is the restaurant labor market looking? (read more here)

Home Depot is focusing on growing its business with professional customers (read more here)

7-Eleven has appointed a new CEO and is planning on doing an IPO in the United States (read more here)

Was this forwarded to you? Sign up here.

Have an idea or want to chat? Respond to this email.

Is the email not reaching your inbox? Try this trick.