Retail wRapped: 2024 Edition

Welcome to the final 2024 issue of Retail Is Not Dead?. I hope everyone is having a great holiday with family and friends! Thank you to all the new subscribers who joined over the past couple of weeks. I really appreciate your support. Thank you also to all the people that shared this newsletter with you which led to you joining the community as well.

For the new folks, normally, each week I do a deep dive into a main trend, highlight 4 positive or negative trends while sharing lessons, feature an emerging noteworthy startup in the retail space, and share some of my favorite stories from the week. However, this week is the special Retail wRapped edition summarizing 2024 and previewing 2025. Next week, we will resume normal programming, but first, let's dive into 2024 and look ahead to 2025.

This year was certainly an eventful time for retail. From a numbers perspective, according to the Census’s Monthly Sales Estimate, retail and food services sales were up 2.9% for the year, with retail specifically being up 2.6%. This number is not adjusted for inflation, but even when adjusted for inflation, it still shows slight growth. In particular, the year ended strong, with November sales up 3.8% YoY, which significantly outpaces inflation in the same time period. In my opinion, any growth for retail is strong given the challenges the industry faces.

From a high-level numbers perspective, it was a strong year for retail, but looking individually at many companies, there was a lot of tumult. Starbucks poached Chipotle’s CEO to be the CEO to hopefully lead its turnaround. PopUp Bagels launched all across the Eastern Seaboard. Nordstrom is being taken private. Dollar stores and drug stores are trying to reinvent themselves, or be forced to close locations. Walmart stock surged as people resonated with the value, omnichannel capabilities, and seemingly endless aisle online or in store. Nike turned over its CEO and tried to recover from focusing too much on D2C rather than retail, a strategy which led to losing market share to On and Hoka. Zooming in on many individual stories, the story is not as pretty.

Given all the chaos this year, I am going to break down the year, get you up to speed on anything you missed, and preview next year. After reading this piece, you should come away with my POV on the 5 top trends of 2024, 5 top trends to look forward to in 2025, 5 retailers looking to have a strong year in 2025, and 5 retailers looking to have a poor year in 2025. I welcome any feedback and opinions. Who are you most excited to follow in 2025? What were some of your favorite trends in 2024? Please don’t hesitate to respond with all the spiciest takes!

2024 Trends Recap

2024 Trends Recap:

Trend 1: Retail as a Partnership Advertising Platform

For long time readers, I have written about this topic ad nauseum, so it is fitting that this 2024 recap section is kicked off discussing advertising through retail (For a deeper dive, check out this piece I wrote). CPG advertising has been a part of retail for a long time, but originally it was very far from the point of purchase and didn’t allow people to try before purchase. As retail advertising evolves, and I am not even diving into the advances in retail media this year, a mutually beneficial partnership in advertising emerged. Championed by PopUp Bagels, who involved CPG brands in its weekly cream cheese drop, hypebeast clothing companies like Kith and Supreme, and others, this type of partnership is another viable channel for retailers to generate additional revenue. Essentially, it is a retailer creating a product that can be switched out at regular cadence with a slight tweak.

The benefit of this approach is twofold for the retailer. First, you generate additional income from the brand sponsoring the product. Second, you give your customers a reason to come back more frequently. More retailers are seeing this benefit and starting to launch a product in this manner. Going forward, I expect this partnership strategy to skyrocket, and even become slightly oversaturated. Still, I believe to be a successful retailer, especially in food & beverage, you need to have a partnership advertising component. On the flip side, as a brand, you need to actively develop a retail partnership advertising strategy.

A collage of all the acquisition in CPG this year

Trend 2: CPG Consolidation

Traditionally, CPG has been dominated by large conglomerates across categories that can leverage the scale to win over shoppers. Think Pepsi Frito Lay, Kraft Heinz, General Mills, Kelloggs, etc. Together these companies represented over $150B in 2023 revenue and you would be hard-pressed to build a basket in a grocery store without any of their products. Like anything in retail, there are also downsides to having these companies control so much of the food market. This year, many of the large food conglomerates struggled due to GLP-1s, inflation, ingredient issues, and more. From their POV, the best way to continue growth is the tried and true method: acquisition. It remains to be seen whether this round of acquisition will pay off and provide the turnaround needed for many of them.

Campbells purchases Sovos Brands for $2.7B (March 2024) - Campbells, the soup and snack manufacturer, acquired Sovos Brands, the manufacturer of premium brands like Rao’s. This purchase extends Campbells into more of the premium area and also gets them into more of the prepared side (non-canned) with several frozen entrees and pizzas under the Sovos umbrella. I think this purchase makes a lot of sense because it is a premium brand with room to grow in complementary categories. According to the press release, Rao’s alone did $775M in 2023 sales (~78% of Sovo’s total sales) - it will be interesting to see if we get any numbers of Rao’s 2024 performance.

Mars Wrigley buys Kellanova for $36B (August 2024) - Mars Wrigley, a private company, dominates the pet care, snacking, and food market with brands like M&M, Five Gum, and Twix. Kellanova is the non-cereal part of what was formerly part of Kellogs until their split in March 2023. Kellanova owns brands such as Pringles, Cheez-It, and Pop Tarts. Unlike Pepsi, which is trying to get into the better for you market, Mars Wrigley is doubling down on what makes it successful, unhealthier snacks and confectionary.

Pepsi Frito Lay (down ~12% YTD) buys Siete Foods for $1.2B (October 2024) - Pepsi in particular has been struggling with many of the affects I mentioned previously, inflation and GLP-1s. Enter Siete Foods, a better for you Mexican-American snack brand that makes tortillas, salsas, seasonings, sauces, cookies, snacks and more, with a cult following due to its super clean ingredients. From a Pepsi POV, it adds products in a segment it is already strong in, but adds customers that it is not reaching right now. There is a lot of concern from Siete customers that product quality will change with the acquisition, but it seems at first it will operate as a stand alone entity, like Stacy’s Pita Chips. Did you know Stacys has been owned by Pepsi since 2006?

Mondelez (down ~19% YTD) had its bid to buy Hershey’s for an undisclosed amount rejected (December 2024) - Mondelez, the snack and confectionery powerhouse, tried to purchase Hershey’s, the confectionary icon, which would have created a super confectionary company. This is the second time Mondelez has gone after Hershey’s, when in 2016 its $23B bid failed. For context, Hershey’s now has a market cap of around $34B. It was not disclosed what the bid was, but it did not satisfy the Hershey shareholders. Given the struggles in the category, and the huge purchase price it would take, I doubt this merger will happen, but expect both to be active in 2024.

Kroger fails to buy Albertsons for ~$25B (December 2024) - While this merger has been in talks since October 2022, in February 2024 the FTC filed a lawsuit to block the merger, and in December a judge agreed with the FTC. This merger would have created a mega grocery chain that would have resulted in nearly 5,000 stores and employed over 700,000 people. These two companies own many regional chains that already dominate their regional markets. While on the retail, not the CPG side, it would have had a tremendous impact on the CPG brands that sell into them and retailers as a whole. Following the ruling, both companies terminated the deal, and Albertsons sued Kroger, so I would not expect it to happen. However, given the magnitude of stores each company controls, I would expect them to both make a splash in retail this year.

Like many of these predictions, I expect consolidation to continue next year. However, for retailers and brands alike, I think this represents a huge opportunity. The big players are always going to exist, but the emerging players are how you are going to differentiate. The retailer to find the next Siete Foods and stock them first is going to win over many customers.

On the acquisition front, I am going to jump on the bandwagon and echo the sentiment that I would be surprised if the largest acquisition next year would not be better for you soda Olipop or Poppi.

Trend 3: Large Retailers Continue to Struggle

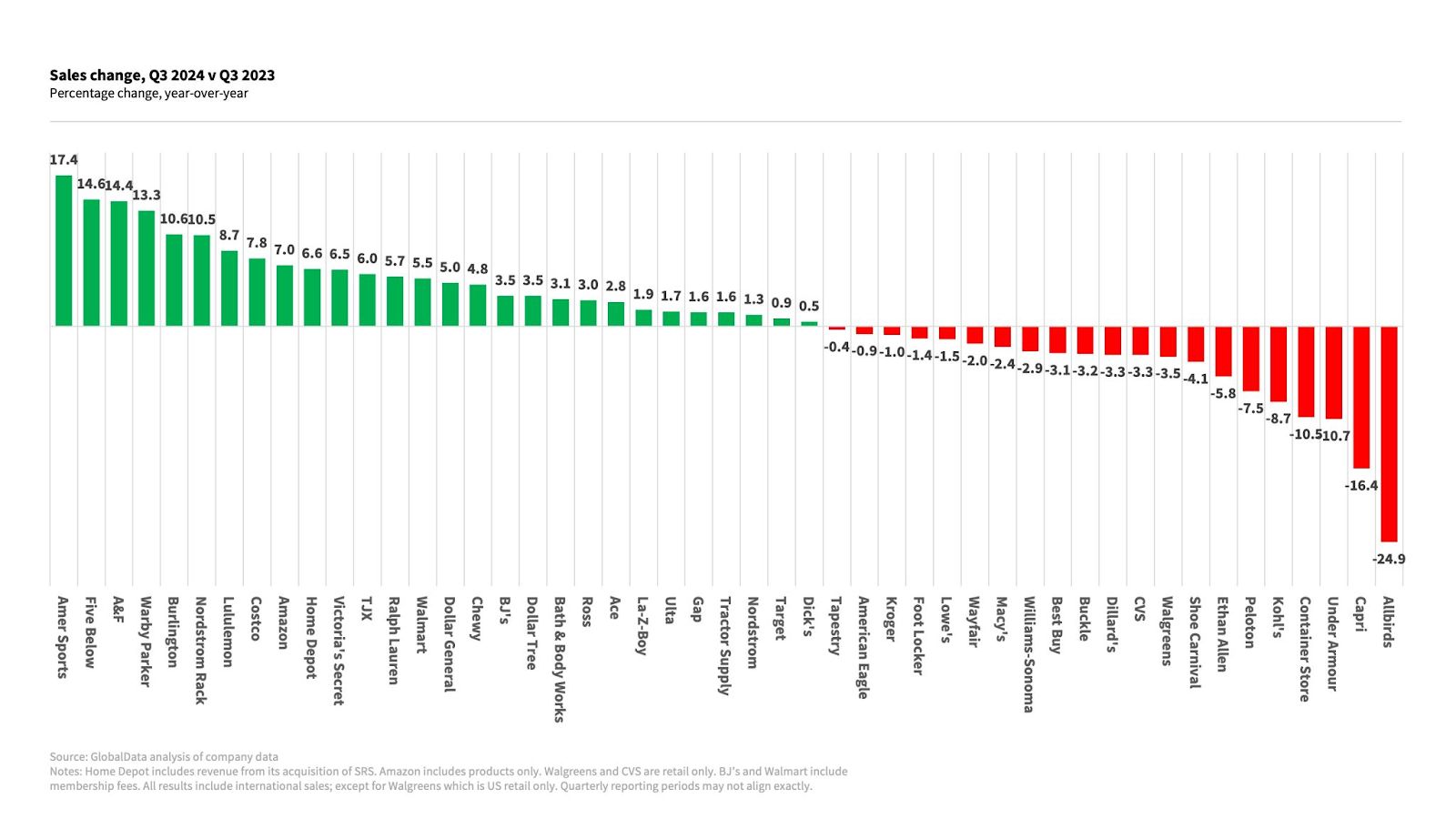

As illustrated in the image below comparing Q3 performance YoY at large retailers from Neil Saunders, an MD at GlobalData Retail, many retailers struggled this year, especially some of the larger, more legacy ones.

To pick a few: Container Store, Kohls, Walgreens, CVS, Best Buy, Macy’s all are seeing decreases in sales YoY. When looking at what is successful and not successful a couple trends emerge.

Customers are seeking value - It’s no coincidence the 3 out of the 6 retailers (Five Below, Burlington, Nordstrom Rack) seeing the most increase in sales are the value focused ones. Customers have shown willingness to spend, albeit in limited amounts. Those stores clearly stand for value, but are more focused on the premium off price value segment, where you can get name brand things for a good price. This is different from a Kohl’s where there are more cheap goods that are unknown brands. Customers want premium brands at value prices.

Legacy retailers with large footprints struggle to move quickly - Some may argue a key reason the retailers are struggling is having a large footprint. I agree, but with the caveat that the innovative and flexible ethos needs to be in the company. Large retailers with large footprints show up on both sides of the graph, but those that can be more nimble are on the left hand side of the chart. Typically, the nimbler companies have that ethos from the top and it embeds in the culture.

Specialization is a double-edged sword - Similar to the previous point, being a specialized retailer can be good and bad. Mostly though, it seems that specialization is getting wrecked by the large retailers with endless aisles, even if you have a premium brand. Customers would rather shop Williams-Sonoma via an Amazon or Walmart than direct. There is the opportunity for limited specialization success, but those tend to be more emerging brands that have not seen their ceiling yet.

Overall, customers are making opinions known via where they are spending their money. They want value, nimbleness, and an endless aisle.

Two of my favorite popups this year plus Stew Leonard’s

Trend 4: Experiential Retail on the Rise

If you grew up in the CT, NY, or NJ area, you probably have heard of a grocery store called Stew Leonard’s. Growing up outside those states, you probably have not come across this experience, however, I urge you to see it at some point. Stew Leonards is a cross between a theme park and supermarket, filled with animatronic animals and foods, and super fun products you can only find there. From my perspective, I have a very high threshold for successful experiential retail given what I have grown up with, and regardless of the quality from my point of view, I also still see the value of it.

This year, more brands tapped into this strategy as a marketing channel, a way to get to know who your most devoted customers are, and an opportunity to generate more sales. For instance, Grillos Pickles and Fishwife, the CPG tinned fish company, (deepdive on Fishwife popup in Issue #20 here) both did their own pop ups in NYC to sell merch and their food items. This trend also fits in with using the retail as a partnership advertising platform, as Fishwife was able to get a large partnership with Klaviyo, the SMS app, through having this retail presence. I strongly believe we are just seeing the beginning of this trend, with the only way to get people in the door in some cases to go all the way to the Stew Leonard's model. Imagine a Grillo’s popup with people making recipes with Grillos and with cooking competitions.

The numbers behind CAVA and Wingstop

Trend 5: Digital / Omnichannel Restaurants Win

Despite many of the challenges those in the food service industry have faced this year with supply chain issues, inflation, and other problems, two companies have stood apart from the pack. Cava (+190% YTD) and Wingstop (+16% YTD) both have leaned in on the digital front. As of Q3, Wingstop had almost 70% of its sales coming from digital channels and Cava has almost 40% coming from digital (For a deep dive into Cava’s Q3 earnings check out Issue #27. Check out Issue #25 for more on Wingstop’s Q3 earnings). In addition to the digital focus, the other benefit is that these brands have not hit their ceiling yet. Cava has roughly 350 locations and the ability to add at least 1,000 more before hitting its ceiling. Similarly, Wingstop has about 2,000 stores and the ability to add another 500-1,000 stores without cannibalizing its existing base. Finally, as well as having sector-leading room to grow and a digital focus, these restaurants are focused on delivering value to a consumer, which echoes some of the other sentiments seen throughout the retail space.

In this upcoming year, can they hold onto the dominant position in their categories? Who else will jump up on the list focusing on the three core pillars (room to grow, digital focus, value)? With these questions in mind, let’s pivot to 2025.

2025 Trends Preview

2025 Trends Preview:

Trend 1: Grocery Gets a Revamp

Chances are, the grocery store you shop at has been around for generations. It may have a new parent company, a couple new features, definitely some new products, but it is still pretty similar to 10 years ago and even 25 plus years ago. Even the upstarts of the industry over the past decade, Whole Foods and Erewhon, were founded in 1980 and 1966 respectively (Erewhon was taken over by its current owners 14 years ago in 2011). Why has there been such a struggle to launch upstarts in space? Out of all the businesses, I believe pure retail grocery incumbents have the most benefits of economies of scale compared to any other industry. Grocery stores have such high fixed operating costs and produce is such a tough business to be in, you really need scale.

However, as illustrated by the rise of Erewhon in LA and the falling off of Whole Foods post acquisition, I do believe there is an opportunity for new concepts who are doing a premium regional retail grocery store with an omnichannel component to succeed and reach 10-20 units, with 10-15k square foot stores, and a total of $100M in revenue. Compared to many software businesses that is a small prize, but it is clear this type of store is something consumers demand. Additionally, one will eventually go national and even become the next national premium grocery store, replacing Whole Foods. I do not believe it will be Erewhon, as I believe what truly makes them great in LA - the concept just wouldn't be the same, even in the rumored NYC location.

Here are the three categories I am watching to fill the gap:

Startups - a totally new concept from a retailer that never existed

Radius Butcher & Grocer - new butcher and grocery store in Austin opening soon, featuring only local products in season and a lot of transparency around the business as well as the sourcing

Happier Grocery - upscale NYC grocer featuring prepared foods and premium CPG items in a smaller format grocery store (for more details check out Issue #26)

Incumbents - a retailer that has been around for a while launching a new concept

Amazon Grocery - 3.8k square foot grocery store in Chicago next to a Whole Foods, trying to incrementally cannibalize Whole Foods shoppers with grocery top ups, coffee, grab and go meals, and name brand items typically not found in a Whole Foods store (Coke, Fritos, etc.)

Whole Foods Daily Shop - smaller format, 9k square foot Whole Foods catering to daily shops with premade and pre-portioned snacks, prepared foods, and meals (Read more in Issue #19)

eComm -> retail - D2C grocery that scales enough to branch into retail

Thrive Market - private label better for you groceries shipped to your door

Weee! - online grocer selling Asian items

So, who will it be, incumbents, startups or an eComm player transitioning to retail? If there are any other grocers I should keep an eye on, please don’t hesitate to share.

Which type of company will build the next great grocery store?

Trend 2: More Spaces to Be Together

In 2020, the pandemic fundamentally shifted how we interact with one another to more isolation, which has skyrocketed the health and other issues accompanied by isolation. Now five years later, I expect a shift in the direction of building more spaces together. Here is how I think it will play out in four key pillars of our day-to-day lives:

Working - On the large company front, many companies are pushing a return to office for 3 plus days of the work week. This shift will lead to expanded retail opportunities around the main offices. On the smaller company front, many companies are pushing hybrid in pods around the country. These pods may be remote, or get together infrequently, but there will be a large demand for the co-working spaces, especially in suburban areas. People may have home offices, but that doesn’t mean they always want to be there. For these types of businesses, flexibility is key.

Playing - Outside of work, with people getting less connection through work, they are going to be looking for ways to connect with others. Plenty of businesses have sprouted up to address this need, and I foresee many more in the coming years. For instance, Othership (Issue #11), the sauna and gym, Cocoon (Issue #25), the play and learning area for kids, and Level99 (Issue #29), a hybrid bar, food, and escape room games.

Living - Many startups have tried and failed to create a co-living space. Most recently, WeWork founder Adam Neumann started a company Flow in the space. I believe a lot of the failure has been around treating these as a startup rather than a property management company. I think those that approach it more from the landlord mindset building amenities, like Lifetime Fitness’s apartments, will succeed. There is also definitely room for software that helps existing landlords level up the community in their existing properties.

Eating/Drinking - These activities are inherently communal dating back to the earliest eating and drinking establishments. Efforts have been made to create software around bringing new people together around food or drink. None have really succeeded yet, but I am still bullish on a concept being able to rise above the rest and figure out a way to bring people together around a meal.

Fundamentally, people are isolated and want to be brought together.

Trend 3: Better Pricing of Clean Label Ingredients

As discussed in the 2024 trend recap above, consumers have been voicing interest in value and cleaner label ingredients by purchasing from certain retailers/brands. Partially, these purchasers are different groups, but there is a significant overlap between the two viewpoints. In this example, I distinguish better for you and clean labels intentionally. Better for you products on the surface are healthier than what they are replacing, but in reality contain different chemicals or additives that reduce the health benefits, like Impossible Foods and Beyond Meat. Clean label would be minimal, chemical-free, high quality ingredients, like Siete Foods chips with a couple ingredients. The one example that stands out as the shining instance of better for you philosophy being a detriment to a brand is Impossible Foods and Beyond Meat. In the end, those products serve a purpose, but a variety of factors including health and price make consumers look for alternatives. As demonstrated in the Siete Foods acquisition by Pepsi, this clean label philosophy of business can have a big impact as Siete Foods products tend to have a very clean label. From a retailer POV, you should keep looking for emerging brands that offer healthy items, with a clean, short label at a good price for what you are getting. From a brand POV, if you are trying to be healthier, you should always be trying to reduce your costs and number of ingredients. The retailers and brands who are able to nail this intersection are going to really stand out above the rest, while winning over customers for the long term. The brands themselves may shift quickly, but people’s philosophies tend to stay similar for longer.

(Update: Shortly after I finished writing this post and scheduled it to publish, the FDA announced it is updating the definition of healthy - read more about it here)

Trend 4: The Great Returns Reckoning of 2025

Right around Black Friday Cyber Monday this year, the National Retail Federation published a fascinating study on returns. It estimated that shoppers were projected to return $890B worth of merchandise in 2024, which amounts to 16.9% of retailers annual sales. Some of those goods will be able to be resold and not all those dollars are a direct loss, but a return is super damaging to the bottom line of the seller.

Retailers have started pushing back over the years on such generous return policies by making cost-benefit decisions on the return if it was worth it and offering discounts or partial refunds to entice them to keep it. I have noticed it the most with Amazon over the years. Now, other retailers are adding costs to the returns and amending the return policies to be less customer-friendly. When I returned a J Crew jacket I bought on Black Friday, they charged me $7.50 to return it, and the UPS Store charged me $1 to package it up. In the past, these services would have been free.

However, it makes sense that in a time of falling profits and demand from customers to reduce prices, one of the first areas to look at to boost economics is returns. Of all the eCommerce industries, I believe the apparel industry will be the most hurt by this, as apparel is one of the hardest items to buy online, some of the most frequently bought items online, and the hardest to resell after being returned. There is clearly not an easy solution for this problem, but I do believe the omnichannel apparel retailers will be the ones able to figure it out. Plus, there is a huge opportunity for startups in the space both enhancing the details before purchase and helping with the return after purchase. One startup doing cool stuff in the space I recently found is Two Boxes, a return processing software for eCommerce shippers and brands.

Sample menu with some logos on it

Trend 5: Restaurants as Advertising Platform

Right now, if you go to a restaurant and look at the menu, there is very little branding on it, especially when you go outside the alcoholic and non-alcoholic beverage section. Contrast that with the grocery store, where everything is branded, and a market opportunity emerges to add branding to restaurants. I believe restaurants are going to start offering sponsored placement on their menu, to combat shrinking profits. Similar to how they sometimes list an ingredient coming from xyz Farm, I believe it will start being listed as coming from xyz Brand. The brand will have paid in some form for that sponsorship.

While this will almost certainly be dominated by the largest brands, I believe there is a huge opportunity for emerging retailers and brands to be ahead of the curve. As highlighted in Issue #24, olive oil startup Graza has been trying to be featured in food service this year because of the marketing, ability to try before purchase, and higher margin opportunity. In addition to the retailers benefiting from the extra revenue, whether it is a sponsored placement or reduced costs, the brands will get more opportunities to win their market. A win-win for both sides that can help everyone increase their bottom lines.

Here is ho I am excited about and worried about

2025 Retailers to Watch

In 2025, some retailers are going to thrive and some are unfortunately going to fail, such is retail. I wanted to highlight some retailers I am excited for and some I am nervous for in 2025, as well as explain why I think that. Here are my thoughts:

Strong Year Ahead:

Lululemon - Fresh off of one of its strongest quarters ever, with revenue up 9% and net income up 42%, Lululemon is poised to finish off the year strong and start next year well. Lululemon saw its most visits ever to the app and eComm site on Black Friday, so I am expecting a strong Q4 too. After struggling for a while, the new CEO has prioritized the actual customer and made sure the assortment matched that customer. Plus, as part of the shift in work and play, athleisure is having a huge moment. Who better to capitalize on it than the leader in the space.

Binstar - As mentioned in the return reckoning section, there is a huge reckoning coming with returns. Part of that change is going to be on the seller, part on the buyer, and part on the actual returns process, but the fourth party of the return reseller will play a role too. Customers want premium items at a value price. Binstart just opened its fourth location this year and there is clearly a customer appetite for more.

PopUp Bagels - In the food space, there are many one hit wonders who get popular and are not able to maintain the momentum. For PopUp Bagels, the hype has died down somewhat, but that has not meant that the success has slowed down. They are churning out new locations, cream cheeses, launching franchising, and even had time to poach a new CEO from the franchising world. I attribute the continued success to fundamentally having a good, repeatable product. People eat a lot of bagels, which are way better piping hot, they like the innovative fun cream cheeses, and PopUp still finds a way to be relevant.

THISBOWL - After launching 45 restaurants in Australia, THISBOWL has its eyes set on the US launching its first location in NYC this year. With a menu featuring build your own bowls inspired by Asian/Australian foods, it naturally fits in with the rise in the bowl restaurants, like CAVA, Sweetgreen, and Chipotle. Despite there being many competitors in the bowl space, I do believe there is an opportunity for one focusing on Asian inspired ingredients. With a sample size of only one THISBOWL location, I have nonetheless noted this one is always packed and doesn't have the same raw fish scaling challenge that many other similar restaurants would face. Some other restaurants with similarish concepts to watch would be Junzi Kitchen, Wow Bao, and Bibibap.

Starbucks - After taking the reins of Chipotle during a tumultuous March 2018 for the company, CEO Brian Niccol oversaw a major turn around, with the stock price rising 770% during his tenure. Now, Starbucks has hired him to oversee a similar turn around during a struggling time for the company. Starbucks is facing an identity crisis, as it charts the next era. Niccol has identified that Starbucks needs to be a place to congregate again, which I strongly support.

Worried for Next Year:

Orange Theory - Recently, the largest franchisee of Orange Theory announced it was going bankrupt. What once was a once profitable workout class now seems to be a fad as people are favoring full gyms. This is the ultimate struggle of becoming too niche regardless of industry. It is going to merge with Anytime Fitness, but is unclear if there is brand value prop alignment, even before you start thinking about locations overlap.

Macy’s - Macy’s is an iconic brand and department store, but like many of its peers in the department store world, has not been nimble enough to move forward in an omnichannel world. The large store footprint clearly doesn't help, but is not the sole reason for the struggle. Some activist investors are getting involved, but it is unclear if their plans will be able to turn everything around. This is certainly going to get ugly, but it is really unclear if there is any path forward.

Nike - Unlike many other retailers, Nike tried to shake it up too much. It went all in on D2C/eCommerce, neglected retail, and completely restructured the company from focusing on sports to just being a general athletics company. This strategy was a disaster and allowed upstarts like Hoka and On to eat into a large chunk of its market share. Plus, the brand lost a lot of the cultural cache and zeitgeist it had. It recently swapped CEOs and is focusing more on retail, which hopefully should help, but until it finds a way to recapture the zeitgeist, it is going to struggle.

Whole Foods - It is no secret Amazon has been trying to get into the grocery space for a while, one of the largest categories they do not really service. With the purchase of Whole Foods in 2017, that was Amazon’s big splash to enter the market. It is safe to say that acquisition has not panned out well. Whole Foods customers, who may also overlap with Amazon’s customers, have not liked the shift and clearly have different standards for purchasing food versus general goods. On the Amazon side, Whole Foods has not been able to be fully integrated into the commerce experience and is instead this weird hybrid. To me it is telling that Amazon is launching a small format grocery store right next to a Whole Foods in Chicago. It is unclear what the future holds for Whole Foods, but it does not seem that it will be positive.

Kohl’s - Customers are searching for value, but they still want to associate with premium brands. This is a delicate balance for retailers to strike. That puts places like Kohl’s, with random off brand items for good prices, in a tough place because they lack the premium brands that are for sale at a Nordstrom Rack or TJX. For a cheaper, off price good, people would rather shift to eCommerce or Walmart to purchase it. There may be an opportunity for a retailer like Kohl’s to squeeze between cheap no-name brands and discounted premium brands, especially since most of its competitors have closed, but it will be interesting to see if with current consumer preferences there is a spot for it.

Thank you for making it to the end! Appreciate all the support this year and, as always, I can always be reached with feedback or ideas at [email protected]

Fun Fact: 9 out of the 32 (28%) issues this year were directly mentioned in this issue!